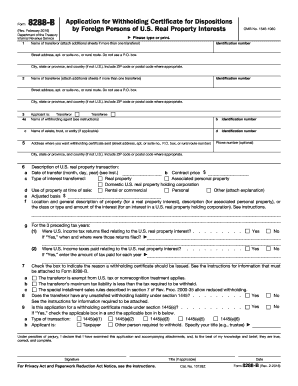

Get Irs 8288-b 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8288-B online

How to fill out and sign IRS 8288-B online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If individuals aren’t linked with document management and legal processes, submitting IRS documents can be exceptionally tiring.

We understand the importance of accurately completing paperwork.

Using our online software will make professional filing of IRS 8288-B a reality. We will do everything for your comfortable and straightforward workflow.

- Click the button Get Form to open it and start editing.

- Fill out all required fields in the chosen document using our expert PDF editor. Activate the Wizard Tool to make the process significantly easier.

- Verify the accuracy of the filled information.

- Include the completion date of IRS 8288-B. Utilize the Sign Tool to generate your unique signature for the document validation.

- Conclude editing by clicking on Done.

- Send this document directly to the IRS in the most convenient manner for you: via email, virtual fax, or postal mail.

- You can print it on paper if a physical copy is needed and download or save it to your preferred cloud storage.

How to modify Get IRS 8288-B 2016: personalize forms online

Forget the conventional paper-based method of handling Get IRS 8288-B 2016. Have the document finalized and signed in no time with our superior online editor.

Are you struggling to alter and finalize Get IRS 8288-B 2016? With a professional editor like ours, you can accomplish this task in mere minutes without the necessity to print and scan documents back and forth. We provide fully adjustable and straightforward document templates that will serve as a foundation and assist you in completing the required document template online.

All forms, automatically, include fillable fields you can execute once you access the template. However, if you need to enhance the existing content of the form or add new details, you can select from various customization and annotation options. Emphasize, obscure, and comment on the document; incorporate checkmarks, lines, text boxes, images, notes, and remarks. Furthermore, you can quickly validate the template with a legally-binding signature. The finished document can be shared with others, stored, imported to external applications, or converted into any common format.

You will never make a poor choice utilizing our web-based solution to manage Get IRS 8288-B 2016 because it's:

Don't waste time completing your Get IRS 8288-B 2016 the outdated way - with pen and paper. Utilize our comprehensive tool instead. It offers you a full suite of editing options, integrated eSignature functions, and user-friendliness. What sets it apart is the team collaboration features - you can collaborate on forms with anyone, establish a structured document approval workflow from start to finish, and much more. Try our online tool and gain the best return on your investment!

- Simple to set up and operate, even for those who haven’t filled the documents digitally in the past.

- Robust enough to meet various editing requirements and document kinds.

- Reliable and secure, ensuring your editing experience is protected at all times.

- Accessible on various devices, making it easy to finalize the document from anywhere.

- Able to create forms based on pre-made templates.

- Compatible with numerous file formats: PDF, DOC, DOCX, PPT, and JPEG etc.

Related links form

The responsibility for filing IRS 8288 falls on the withholding agent, which is usually the buyer in a property transaction involving a foreign seller. It’s essential for these agents to understand their obligations under FIRPTA, the Foreign Investment in Real Property Tax Act. Utilizing platforms like uslegalforms can provide clarity and guidance for these filings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.