Loading

Get Irs 8082 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8082 online

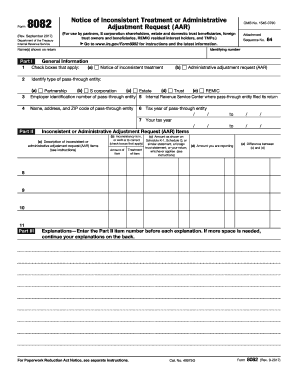

The IRS 8082 form is essential for individuals involved in pass-through entities who need to report inconsistent treatment or make an administrative adjustment request. This guide provides clear, step-by-step instructions to help users efficiently complete the form online.

Follow the steps to fill out the IRS 8082 form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the identifying number associated with your tax return, along with the names as they appear on your return in the designated fields.

- In Part I, check the appropriate boxes that apply to your situation, including the type of pass-through entity you are dealing with, such as a partnership or S corporation.

- Enter the employer identification number of the pass-through entity and the IRS Center where the entity filed its return.

- Provide the name, address, and ZIP code of the pass-through entity in the specified fields.

- In Part II, specify whether you are reporting a notice of inconsistent treatment or an administrative adjustment request (AAR) by checking the appropriate box.

- Fill in the tax year of the pass-through entity and your own tax year by entering the relevant dates in the provided format.

- Detail the inconsistent or administrative adjustment request items by providing descriptions and indicating where the inconsistencies lie in the corresponding fields.

- For each item, report amounts as per the Schedule K-1 or other relevant statement and indicate any differences between those amounts and the ones you are reporting.

- In Part III, provide explanations for each item listed in Part II by entering the item numbers followed by your detailed explanations.

- Once you have filled out all necessary fields and provided explanations, you can save changes, download, print, or share the completed form as needed.

Complete the IRS 8082 form online today to ensure accurate reporting of your tax situation.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The number of withholding allowances you claim should be based on your personal and financial situation, including dependents and tax credits. It is vital to complete the IRS worksheets accurately to calculate the correct number. Using the IRS 8082 can help you address specific issues that may affect your withholding allowances, leading to more accurate tax payments.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.