Loading

Get Irs 7004 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 7004 online

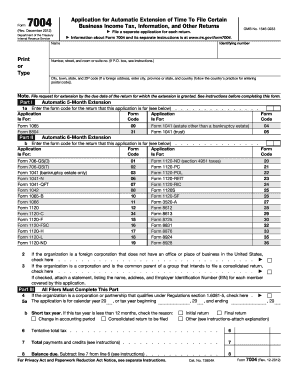

The IRS 7004 form is used to request an automatic extension of time to file certain business income tax and information returns. Filling out this form correctly ensures that you have the additional time you need to prepare your submissions without incurring penalties.

Follow the steps to complete the IRS 7004 form online

- Click the ‘Get Form’ button to obtain the IRS 7004 form and open it in your online environment.

- Begin by entering the identifying number of your business. This is usually your Employer Identification Number (EIN).

- Next, input the name of your business. Make sure to print or type the name clearly.

- Provide the address of your business, including the number, street, and room or suite number. If using a P.O. box, refer to the instructions for proper formatting.

- Fill in the city, town, state, and ZIP code of your business. If your address is foreign, include the city, province or state, and country as per that entity's postal practices.

- In Part I, select the appropriate form code for the return you are requesting an extension for. Include the form code for either a 5-month or a 6-month extension.

- Indicate if your organization meets any specific conditions, such as being a foreign corporation or a corporation that plans to file a consolidated return.

- Complete Part III, making sure to check whether your organization qualifies under the relevant regulations and indicating the tax year this application pertains to.

- If applicable, check the reason for a short tax year and fill in the accompanying dates for your tax period.

- Finally, review all fields for accuracy. Once satisfied, you can save your changes, download the completed form, print it out, or share it as needed.

Start filling out your IRS 7004 form online today to ensure timely submission and avoid penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The primary difference between form 7004 and 4868 lies in their purpose. IRS form 7004 is for businesses seeking an extension to file tax returns, while form 4868 serves individual taxpayers. Both forms provide additional time to file, but it's crucial for businesses to use form 7004 correctly. If you're unsure which form to use, US Legal Forms can provide clear guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.