Get Irs 668-w(c)(do) 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 668-W(c)(DO) online

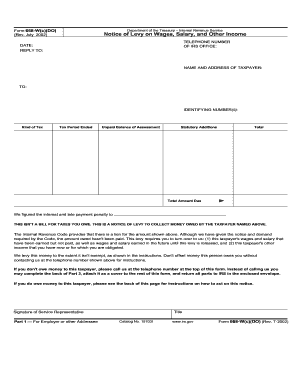

The IRS Form 668-W(c)(DO) is a crucial document used by employers to respond to a notice of levy on wages, salary, and other income. Understanding how to complete this form accurately is essential for ensuring compliance with IRS requirements.

Follow the steps to fill out the IRS 668-W(c)(DO) online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the telephone number of the IRS office listed on the form at the designated section.

- Next, input the date you are filling out the form in the appropriate field.

- Provide the name and address of the taxpayer as specified in the corresponding fields.

- Enter the identifying number(s) associated with the taxpayer in the specified area.

- Indicate the type of tax involved and the tax period that has ended.

- Fill in the unpaid balance of assessment, statutory additions, and the total amount due as applicable.

- If applicable, complete the Statement of Exemptions and Filing Status, including checking the appropriate filing status and listing any eligible exemptions.

- Once completed, ensure that all signatures required are in place, particularly from the taxpayer.

- Finally, save changes to the document, download the completed form, and print it for submission or sharing as needed.

Complete your forms online to ensure swift processing and compliance with IRS standards.

Related links form

To obtain a release from an IRS lock-in letter, you need to show that your tax situation has changed or that the information the IRS has is inaccurate. Communicate with the IRS, provide updated personal information, and possibly submit an amended return if needed. Following their instructions precisely can help you navigate the release process. For additional support, USLegalForms can offer the necessary forms and guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.