Get Irs 656 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 656 online

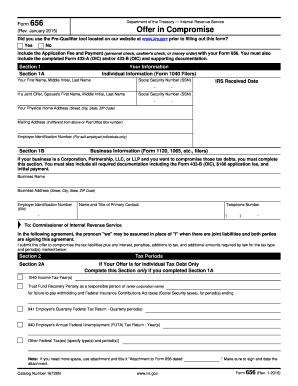

The IRS 656 form, known as the Offer in Compromise, allows individuals to settle their tax debts for less than the full amount owed. Understanding the process of filling out this form online is crucial for effectively managing your tax obligations.

Follow the steps to fill out the IRS 656 online easily.

- Select the ‘Get Form’ button to download the IRS 656 form and open it in the appropriate editor.

- In Section 1A, provide your personal information including your first name, middle initial, last name, and Social Security Number. If this is a joint offer, include your partner's details as well.

- Fill out your physical home address and mailing address if it’s different. If you're self-employed, also include your Employer Identification Number (EIN).

- Complete Section 1B if you are filing for business tax debt. Input your business name, address, and EIN, along with the primary contact's name and phone number.

- In Section 2, indicate the tax periods for which you are making the offer. Be sure to complete 2A for individual tax debts or 2B for business tax debts as applicable.

- Provide the reason for your offer in Section 3, choosing from doubt as to collectibility or exceptional circumstances. Attach any necessary documentation that supports your claims.

- In Section 4, check if you qualify for Low-Income Certification based on your household income and family size. This can exempt you from initial payment requirements.

- Detail your payment terms in Section 5, selecting between lump sum cash or periodic payments and ensuring that calculations are accurate.

- Explain your source of funds in Section 7, indicating where you'll obtain the funds necessary to complete your offer.

- Review the offer terms in Section 8, ensuring that you understand and agree to the stipulations before signing the form in Section 9.

- Make copies of the completed form and any supporting documents for your records, then submit the form as instructed with the required payment.

Start the process of managing your tax obligations by completing your IRS 656 form online today.

Get form

To fill out a tax exemption, you'll need to provide your identifying information and specify the reason for the exemption, usually based on your current financial or tax status. Make sure to verify your eligibility for claiming an exemption before submitting the form. Mistakes could lead to complications, so reviewing guidelines and using reputable resources like USLegalForms can be beneficial for accurate completion.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.