Loading

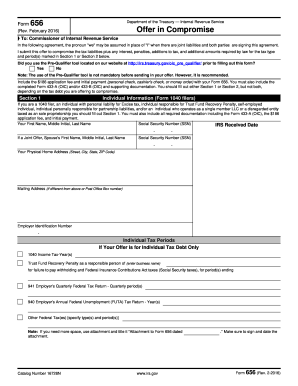

Get Irs 656 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 656 online

The IRS 656 form, also known as the Offer in Compromise, is a critical document for individuals and businesses seeking to settle tax liabilities with the Internal Revenue Service. This guide will provide you with a clear, step-by-step approach to effectively fill out the IRS 656 online.

Follow the steps to successfully complete the IRS 656 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Read the instructions carefully before starting. Ensure you understand the requirement of including completed financial statements, the application fee of $186, and initial payment with the form.

- Indicate if you utilized the Pre-Qualifier tool by selecting 'Yes' or 'No' in the provided field.

- Choose between Section 1 for Individual information or Section 2 for Business information based on your circumstances. Fill out the relevant section based on the type of tax liabilities you are addressing.

- In Section 1, provide your personal details including first name, last name, social security number, physical address, and include necessary documentation such as Form 433-A (OIC). If filing jointly, include the spouse’s information.

- In Section 2, for businesses, provide the business name, address, employer identification number, and contact details. Also, include required documentation such as Form 433-B (OIC).

- State your reason for the offer in Section 3. Choose between options like Doubt as to Collectibility or Exceptional Circumstances, and provide a detailed explanation if necessary.

- Specify payment terms in Section 4. Choose between Lump Sum Cash or Periodic Payment options and enter the amounts and schedule for payments.

- In Sections 5 and 6, indicate how you want your payment applied and provide the source of funds for the payment. Ensure that separate checks for the payment and application fee are included.

- Review and sign Section 8 under penalties of perjury, ensuring all information is accurate before submission.

- Finally, save your changes, and you can either download, print, or share the completed form as needed.

Complete your IRS documents online to ensure a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can file the IRS 656 form on your own; however, it can be complex. If you choose to go solo, it's crucial to gather all relevant financial documents and understand IRS guidelines thoroughly. For many, working with a platform like US Legal Forms can simplify the process and reduce the likelihood of errors in your submission.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.