Loading

Get Irs 5472 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5472 online

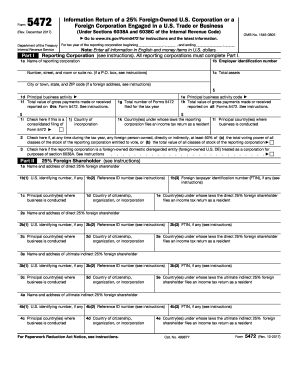

The IRS Form 5472 is an essential document for foreign-owned U.S. corporations to report specific transactions and ownership information. Understanding how to accurately fill out this form is crucial for compliance and avoiding penalties.

Follow the steps to effectively complete your IRS 5472 online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Enter the tax year for the reporting corporation starting and ending dates, ensuring you format it correctly as per IRS guidelines.

- Fill in Part I by providing the name, employer identification number (EIN), address, total assets, principal business activity, and country of incorporation.

- In sections regarding foreign ownership, check the box if any foreign person owned at least 50% of voting power or total stock value during the tax year.

- Complete Part II, where you will input details related to the direct 25% foreign shareholder, including their name, address, and taxpayer ID numbers.

- Provide information about ultimate indirect foreign shareholders in Part II, ensuring accuracy in names and jurisdictions.

- In Part III, specify the relationship of any related party to the reporting corporation and fill in their details accordingly.

- Complete Part IV by reporting all monetary transactions between the reporting corporation and foreign related parties, including revenues and costs.

- Finish with Parts V, VI, and VII as needed to provide information on additional transactions and any cost-sharing arrangements.

- After reviewing all entered information for accuracy, save your changes, and then download, print, or share the completed form.

Complete your IRS 5472 online today to ensure compliance and avoid potential penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, foreign wire transfers can be reported to the IRS under certain conditions, especially if the transfer exceeds $10,000. These regulations help crack down on tax evasion and ensure financial transparency. If you are unsure about your reporting obligations, consider utilizing USLegalForms to clarify your responsibilities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.