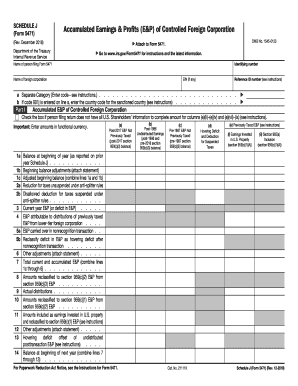

Get IRS 5471 - Schedule J 2018

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 901j online

How to fill out and sign Form5471 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If people aren?t connected to document managing and legal operations, filling out IRS documents will be very hard. We comprehend the importance of correctly finalizing documents. Our service proposes the way to make the mechanism of completing IRS forms as easy as possible. Follow these tips to quickly and properly fill out IRS 5471 - Schedule J.

How you can complete the IRS 5471 - Schedule J online:

-

Click the button Get Form to open it and begin editing.

-

Fill out all required lines in the selected file making use of our powerful PDF editor. Switch the Wizard Tool on to finish the process even simpler.

-

Make sure about the correctness of added info.

-

Add the date of submitting IRS 5471 - Schedule J. Utilize the Sign Tool to create a special signature for the document legalization.

-

Finish modifying by clicking Done.

-

Send this document directly to the IRS in the most convenient way for you: via email, making use of virtual fax or postal service.

-

You have a possibility to print it on paper when a hard copy is required and download or save it to the preferred cloud storage.

Utilizing our online software can certainly make expert filling IRS 5471 - Schedule J possible. We will make everything for your comfortable and simple work.

How to edit OMB: customize forms online

Choose a rock-solid file editing solution you can trust. Edit, execute, and sign OMB securely online.

Very often, editing documents, like OMB, can be pain, especially if you got them online or via email but don’t have access to specialized tools. Of course, you can find some workarounds to get around it, but you risk getting a document that won't fulfill the submission requirements. Utilizing a printer and scanner isn’t a way out either because it's time- and resource-consuming.

We provide an easier and more streamlined way of modifying forms. A comprehensive catalog of document templates that are easy to customize and certify, to make fillable for some individuals. Our platform extends way beyond a set of templates. One of the best aspects of using our services is that you can change OMB directly on our website.

Since it's a web-based option, it saves you from having to get any application. Additionally, not all corporate policies permit you to download it on your corporate computer. Here's how you can easily and securely execute your paperwork with our platform.

- Hit the Get Form > you’ll be immediately taken to our editor.

- As soon as opened, you can kick off the editing process.

- Choose checkmark or circle, line, arrow and cross and other options to annotate your form.

- Pick the date option to include a specific date to your document.

- Add text boxes, photos and notes and more to complement the content.

- Utilize the fillable fields option on the right to add fillable {fields.

- Choose Sign from the top toolbar to generate and add your legally-binding signature.

- Hit DONE and save, print, and pass around or get the document.

Forget about paper and other inefficient ways of completing your OMB or other forms. Use our tool instead that combines one of the richest libraries of ready-to-edit forms and a robust file editing services. It's easy and secure, and can save you lots of time! Don’t take our word for it, give it a try yourself!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing reclassify

Watch our video to discover how you can easily complete the viii and understand the advantages of using online templates. Simplify your paperwork with excellent web-based tools.

Nonpreviously FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to IRS 5471 - Schedule J

- vii

- subpart

- posttransaction

- unsuspended

- reclassify

- viii

- nonpreviously

- EIN

- 901j

- codesee

- subtractions

- form5471

- OMB

- 21111k

- IX

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.