Get Irs 4852 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4852 online

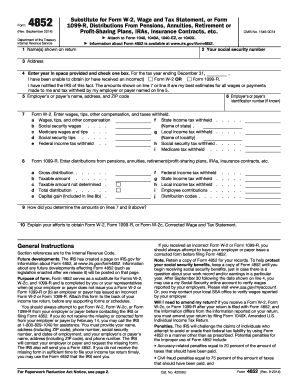

Filling out the IRS Form 4852 can appear complex, but with this comprehensive guide, users will find step-by-step instructions tailored to simplify the process. This form serves as a substitute for Form W-2 or Form 1099-R when those documents are not available or are incorrect.

Follow the steps to complete your IRS 4852 online easily.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the name(s) as shown on the return, your social security number, and your current address, including the city, state, and ZIP code.

- For line 4, input the tax year for which you are completing the form and check the appropriate box indicating whether you were unable to obtain the correct Form W-2 or Form 1099-R.

- Line 5 requires you to enter your employer's or payer's name, address, and ZIP code. If you have the identification number, provide that information on line 6.

- Proceed to complete lines 7 and 8 by entering the necessary details from Form W-2 or Form 1099-R. For line 7, include your wages, federal income tax withheld, and state/local taxes where applicable.

- If filling out line 8, provide details for distributions from pensions or annuities, including gross distribution and any applicable tax information.

- On line 9, explain how you calculated the amounts you entered on lines 7 and 8, indicating any pay stubs or statements you used as references.

- Line 10 requires you to describe your efforts to request the correct Form W-2 or Form 1099-R from your employer or payer.

- Once you have completed the form, review all entries for accuracy, then save your changes. You can download or print the completed form for attachment to your income tax return.

Complete your IRS 4852 online efficiently and ensure your tax obligations are met.

Get form

Filling out Form 4852 involves carefully entering your identifying information, estimated income, and the amount of federal income tax withheld. Use your best judgment and any available documentation to provide accurate figures. After completing the form, review it for accuracy, and make sure to sign and date it before submission. For ease of use and support, check out the resources available at USLegalForms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.