Get Irs 4797 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 4797 online

How to fill out and sign IRS 4797 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t linked with document administration and legal procedures, submitting IRS documents can be quite daunting. We understand the significance of properly finalizing paperwork.

Our platform provides the solution to simplify the process of completing IRS forms as effortlessly as possible. Adhere to these guidelines to accurately and swiftly file IRS 4797.

Using our online application will facilitate professional submission of IRS 4797. We prioritize making everything suitable for your efficient and prompt work.

Click on the button Get Form to access it and begin editing.

Complete all required fields in the document using our beneficial PDF editor. Activate the Wizard Tool to make the process even simpler.

Verify the accuracy of the entered information.

Specify the date of completing IRS 4797. Utilize the Sign Tool to create your signature for the document validation.

Conclude modifications by clicking Done.

Submit this document directly to the IRS in the most convenient method for you: via electronic mail, using virtual fax, or postal service.

You have the option to print it on paper if a hard copy is necessary and download or save it to your preferred cloud storage.

How to modify Get IRS 4797 2011: personalize forms online

Complete and endorse your Get IRS 4797 2011 swiftly and without mistakes. Obtain and amend, and endorse customizable form templates in the convenience of a single tab.

Your document processing can be significantly more productive if all you require for altering and managing the workflow is organized in one location. If you’re searching for a Get IRS 4797 2011 form template, this is the right spot to acquire it and complete it without pursuing external options. With this advanced search tool and editing application, you won’t have to search any further.

Simply enter the title of the Get IRS 4797 2011 or any other form and discover the appropriate template. If the template appears suitable, you can start modifying it immediately by clicking Get form. There's no need to print or even download it. Hover and click on the interactive fillable areas to input your details and endorse the form in a single editor.

Utilize additional editing tools to personalize your template:

Store the form on your device or change its format to your desired one. When equipped with an intelligent forms directory and a robust document editing solution, working with paperwork becomes simpler. Locate the form you need, complete it promptly, and sign it instantly without downloading it. Simplify your document handling routine with a solution specifically designed for editing forms.

- Select interactive checkboxes in forms by clicking on them.

- Inspect other sections of the Get IRS 4797 2011 form text with the aid of the Cross, Check, and Circle tools.

- If you need to add more text into the document, use the Text tool or insert fillable fields with the respective button. You may also define the content of each fillable area.

- Insert images into forms using the Image button. Upload images from your device or capture them with your computer camera.

- Incorporate custom visual features to the document. Employ Draw, Line, and Arrow tools to annotate the form.

- Cover text in the document if you wish to conceal it or emphasize it. Obscure text segments with the Erase and Highlight, or Blackout tools.

- Add personalized elements such as Initials or Date with the corresponding tools. They will be created automatically.

Get form

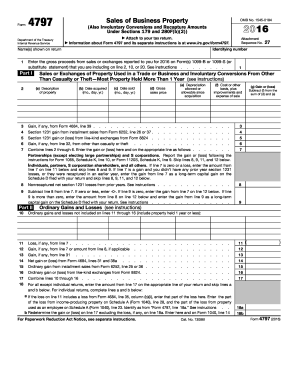

To report the sale of business assets, use IRS 4797 to disclose both gains and losses. This form allows you to calculate depreciation recapture and section 1231 gains if applicable. Document all related transaction details, and keep your records organized for easy reference. Consider utilizing platforms like US Legal Forms for guidance on your specific situation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.