Loading

Get Irs 4562 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4562 online

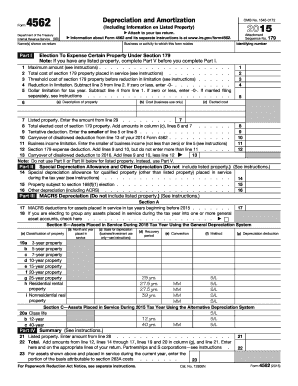

The IRS Form 4562 is used for reporting depreciation and amortization of property. This guide will help you navigate the online filing process step by step, ensuring you complete the form accurately and efficiently.

Follow the steps to fill out the IRS 4562 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name(s) as shown on your tax return in the designated fields.

- Complete Part I by listing the description of your property, its cost, and selected costs for Section 179. Ensure you follow the instructions regarding any listed property.

- Proceed to Part II to fill in the maximum amount for Section 179, total cost of eligible property placed in service, and any applicable limitations.

- In Part III, include details for MACRS depreciation by categorizing your assets based on their classification, month and year placed in service, and other relevant information.

- If applicable, provide information in Part IV about listed property and ensure total amounts are correctly calculated.

- Complete Part V by answering questions related to vehicle usage and ensuring that all required details, including depreciation deductions, are captured.

- Finally, review all sections for accuracy. You can then save your changes, download the form, print it, or share it as necessary.

Begin filling out your IRS Form 4562 online today to streamline your tax reporting process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A depreciation allowance is a tax deduction that reflects the decline in value of an asset over time. This allowance allows businesses to recover the costs of assets used in generating income. By accurately calculating this allowance on IRS Form 4562, you can lower your taxable income effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.