Loading

Get Where To Fax Form 433 D 2005 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

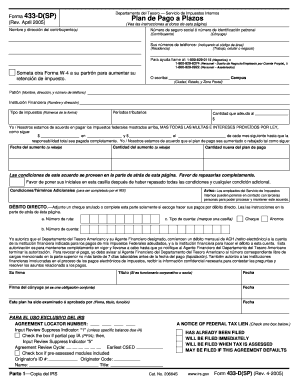

How to fill out the Where To Fax Form 433 D 2005 online

This guide provides detailed instructions on filling out the Where To Fax Form 433 D 2005 online, ensuring a smooth and efficient process. Follow these steps to ensure accuracy and compliance while managing your tax obligations.

Follow the steps to effectively complete your form.

- Press the ‘Get Form’ button to download the form and open it in your preferred online editor.

- Complete the taxpayer's name and address fields accurately, ensuring all details are current.

- Enter the Social Security number or Employer Identification Number in the designated sections for both the taxpayer and spouse if applicable.

- Provide the phone numbers for both the residence and work, including area codes, to facilitate communication.

- Fill in the campus address as specified, following it with the relevant employer's name, address, and phone number.

- Indicate the type of tax and the corresponding tax periods you are addressing in the form.

- State the total amount owed, ensuring it matches your records.

- Outline your agreed payment amount, frequency, and the date when future payments will be made each month.

- Review the terms and conditions provided on the back of the document carefully, then initial where required to confirm understanding.

- If opting for direct debit payments, complete the necessary banking information, including account and routing numbers.

- Sign and date the form; you may also need your spouse's signature in the case of joint liability.

- Finalize your process by saving your changes, and choose to download, print, or share the completed form as needed.

Complete your tax obligations by filling out and submitting your documents online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The location to fax your documents to the IRS depends on the specific form you are submitting. Each form has its designated fax number that you can find in the form's instructions or on the IRS website. If you are submitting Form 433 D 2005, it’s essential to know its specific directing fax number to avoid any delays.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.