Loading

Get Irs 433-d 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 433-D online

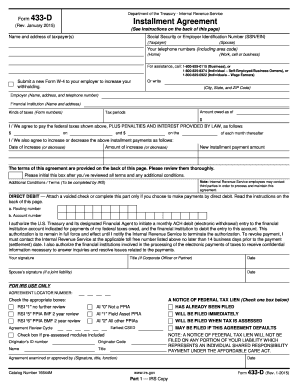

Completing the IRS 433-D form online can simplify the process of setting up your installment agreement for tax payments. This guide provides clear, step-by-step instructions to help you navigate each section of the form effectively.

Follow the steps to easily fill out the IRS 433-D form online.

- Click ‘Get Form’ button to access the IRS 433-D online form and open it in your preferred editor.

- Enter your name and address in the designated fields. Ensure to include your spouse’s name if you are filing jointly. This is crucial for proper identification in the IRS system.

- Fill in your Social Security Number (SSN) or Employer Identification Number (EIN) as applicable. Make sure to double-check for accuracy.

- Provide your contact information, including home and work telephone numbers, to facilitate communication with the IRS.

- Specify the name, address, and phone number of your employer and financial institution. This information is vital for IRS records.

- Indicate the amount you owe as of the date of filing. This number is essential for determining your payment plan.

- List the tax periods and types of taxes you are addressing. This helps clarify the obligations you are consolidating into the installment agreement.

- Agree to the terms outlined on the form by providing your signature, along with the date. If applicable, also have your spouse sign.

- Consider opting for direct debit by filling in the routing and account numbers if you wish to authorize automatic monthly withdrawals for your payments.

- After completing all sections, review your entries for correctness. Save your changes, download a copy for your records, and proceed to print or share the form as needed.

Start filling out the IRS 433-D form online today to manage your tax payments efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To fill out your tax withholding form accurately, start by reviewing your income, tax deductions, and personal situation. Use the IRS guidelines to determine the correct number of allowances. For added assistance, US Legal Forms offers tools that simplify the completion of this important document.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.