Loading

Get Irs 433-b (sp) 2013

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 433-B (SP) online

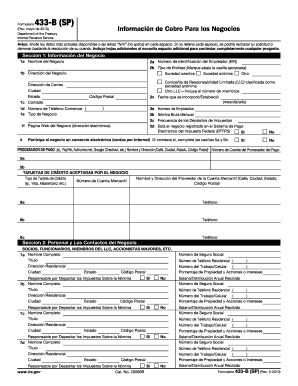

The IRS 433-B (SP) form is essential for businesses when providing financial information to the Internal Revenue Service. This guide will help you navigate the form's sections effectively when filling it out online.

Follow the steps to complete the IRS 433-B (SP) form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin with Section 1, which requires your business information. Enter the name of the business, the Employer Identification Number (EIN), and the business address. Make sure to specify the type of entity by checking the appropriate box.

- Continue to provide additional details such as your phone number, the date the business was established, and average monthly payroll. If applicable, indicate if your business is registered with the Electronic Federal Tax Payment System.

- Move to Section 2 to list important contacts associated with the business. Include names, titles, residential addresses, and roles related to payroll deposits.

- In Section 3, address various financial questions. Specify if you use a payroll service, if the business is involved in any litigation, or has ever declared bankruptcy.

- Next, in Section 4, report on your business's liabilities and assets. This includes cash on hand, bank accounts, receivables, inventory, and property.

- Proceed to Section 5 for reporting income and expenses. Detail your average monthly income and expenses over the past several months.

- After completing all sections, review your responses carefully. Make any necessary adjustments, then save your changes, download the completed form, or print it for your records.

Complete your IRS 433-B (SP) form online today to ensure smooth processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The IRS verifies self-employment income through various methods, including matching reported income with third-party documentation and reviewing tax returns. They may also request additional information or documents if discrepancies arise. By understanding effective reporting through IRS 433-B (SP), you can minimize verification issues and maintain accurate financial records.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.