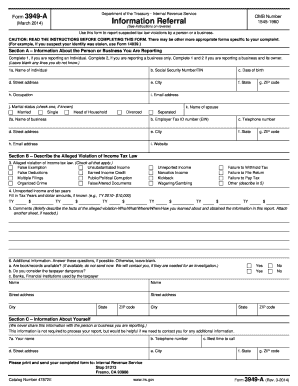

Get Irs 3949-a 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 3949-A online

How to fill out and sign IRS 3949-A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If you aren't affiliated with document administration and legal processes, completing IRS forms can be rather challenging. We recognize the significance of accurately finalizing documents. Our service provides the solution to simplify the task of submitting IRS documents as straightforward as possible.

Adhere to these instructions to efficiently and correctly file IRS 3949-A.

Utilizing our platform can certainly transform efficient completion of IRS 3949-A into a reality. Ensure everything is arranged for your comfortable and secure operation.

- Select the button Get Form to access it and start modifying.

- Complete all required fields in your document utilizing our robust and user-friendly PDF editor. Activate the Wizard Tool to make the process even simpler.

- Verify the accuracy of the provided information.

- Include the date of submitting IRS 3949-A. Use the Sign Tool to create your unique signature for the document validation.

- Conclude editing by clicking on Done.

- Send this document directly to the IRS in whichever manner is most convenient for you: through e-mail, using digital fax or conventional mail.

- You have the option to print it out on paper if a physical copy is necessary and download or save it to your preferred cloud storage.

How to modify Get IRS 3949-A 2014: personalize documents online

Place the appropriate document modification tools at your fingertips. Implement Get IRS 3949-A 2014 with our trustworthy solution that merges editing and eSignature capabilities.

If you wish to implement and validate Get IRS 3949-A 2014 online effortlessly, then our web-based solution is the perfect choice. We offer an extensive template-based library of ready-to-edit forms you can complete online. Additionally, you don't have to print the document or use external solutions to make it fillable. All the necessary tools will be instantly available once you open the file in the editor.

Let’s explore our online editing instruments and their key functions. The editor boasts an intuitive interface, so it won't require much time to understand how to navigate it. We’ll review three primary sections that allow you to:

In addition to the features mentioned above, you can safeguard your file with a password, insert a watermark, convert the document to the desired format, and much more.

Our editor simplifies the process of modifying and certifying the Get IRS 3949-A 2014. It enables you to accomplish nearly everything related to document handling. Furthermore, we consistently ensure that your document editing experience is secure and compliant with primary regulatory standards. All these factors make using our solution even more pleasing.

Access Get IRS 3949-A 2014, make the necessary modifications and adjustments, and download it in your preferred file format. Try it today!

- Modify and annotate the template

- The upper toolbar is equipped with tools that assist you in highlighting and blacking out text, excluding images and graphic elements (lines, arrows, checkmarks, etc.), signing, initializing, dating the document, and more.

- Organize your documents

- Utilize the toolbar on the left if you wish to rearrange the document or delete pages.

- Make them shareable

- If you intend to make the document fillable for others and distribute it, you can utilize the tools on the right to add various fillable fields, signature and date, text box, etc.

Get form

If someone claims your child as a dependent without your permission, it can complicate your tax filing. You have the right to contest this claim through the IRS process. Filing a report using IRS 3949-A is an essential step in addressing this issue, as it alerts the IRS to the fraud.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.