Loading

Get Irs 2553 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2553 online

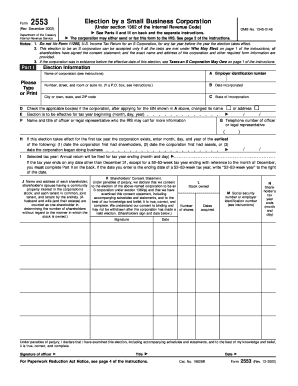

Filing Form 2553 is essential for small business corporations that wish to elect S corporation status. This guide provides clear instructions on how to accurately complete the IRS 2553 form online, ensuring you meet all necessary requirements and deadlines.

Follow the steps to successfully fill out the IRS 2553 online.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- In Part I, provide the election information. Include the name of the corporation, employer identification number, and address. Ensure the information is typed or printed clearly.

- Indicate the date of incorporation in the specified field, along with the city, state, and ZIP code.

- If applicable, check the box indicating if the corporation has changed its name since applying for the employer identification number.

- Specify the effective date of the election for the tax year by entering the relevant month, day, and year.

- Provide the name and title of the officer or legal representative who can be contacted for further information regarding the election.

- Enter the telephone number of the contact listed in the previous step.

- Record the date when the corporation first had shareholders, assets, or began doing business, using the appropriate fields.

- Select the tax year that will be filed for, ensuring any specific requirements for fiscal years are met.

- List the names and addresses of each shareholder and their respective community property interests.

- Ensure all shareholders sign the consent statement, indicating their agreement to the S election, and enter their respective tax year ends.

- Complete Part II if the tax year is not December 31, indicating if the corporation is changing, adopting, or retaining a specific tax year.

- If necessary, complete Part III to elect a Qualified Subchapter S Trust, entering all relevant beneficiary and trust information.

- Review all information entered on the form for accuracy before completing it.

- Once everything is reviewed, save changes, download, print, or share the form as needed.

Start filling out your IRS 2553 document online today to ensure your S corporation status is established.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

There is no deadline to file Form 8832. It can be filed anytime during a businesses' lifetime. ... Up to 75 days before filing the form. Up to one year after filing the form.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.