Loading

Get Irs 2159 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2159 online

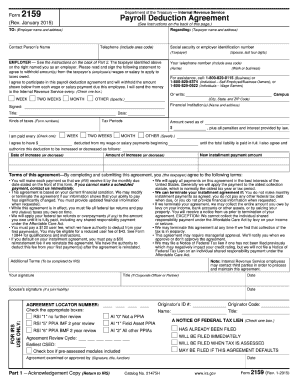

The IRS 2159 form is essential for individuals seeking to authorize a third party to represent them before the Internal Revenue Service. This guide provides clear instructions on how to complete the form online, ensuring a smooth submission process.

Follow the steps to accurately complete the IRS 2159 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields, including your name, address, and Social Security number. Ensure all details are accurate to avoid processing delays.

- Next, provide the representative's information, including their name and contact details. This is the person who will be authorized to act on your behalf.

- Review the specific powers you are granting to your representative. This may include access to your tax records and the authority to sign documents on your behalf.

- Once all fields are completed, carefully review your entries for accuracy. Double-check any identification numbers and contact information to minimize errors.

- Finally, save your changes and choose to download, print, or share the form as necessary. Ensure you retain a copy for your records.

Complete your IRS 2159 form online today for a hassle-free experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file a grievance with the IRS, you should utilize Form 911. This form requests assistance from the Taxpayer Advocate Service, which can help resolve serious issues with the IRS. Providing supporting documentation and a clear explanation of your grievance is vital for the best results. You may also want to reference Form 2159, as it can offer additional context regarding your financial situation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.