Loading

Get Ak 0405-6300i 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK 0405-6300i online

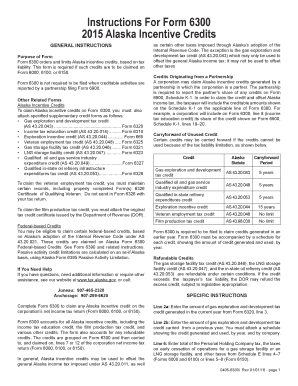

Filling out the AK 0405-6300i form online is an essential step for claiming Alaska incentive credits. This guide provides detailed instructions to help users navigate through the form easily and efficiently.

Follow the steps to successfully complete the AK 0405-6300i form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out the form by entering the required data in Line 2a, where you provide the amount of the gas exploration and development tax credit generated in the current year from Form 6320, line 3.

- In Line 2b, input the amount of the gas exploration and development tax credit carried from a previous year. Make sure to attach a schedule showing the credit generated and used by year and by company.

- Continue to Line 6, where you will enter the total of the Personal Holding Company tax and other relevant taxes based on the specified schedules.

- For Line 8, input the tentative income tax education credit from Form 6310, line 9.

- Next, in Line 11, enter the amount of the qualified oil and gas service industry expenditure credit from Form 6327, line 3.

- Line 12 requires you to input the amount of the qualified oil and gas service industry expenditure credit carried from a previous year; include the required schedule with your submission.

- Move to Line 16 and enter the amount of the qualified in-state oil refinery expenditures credit generated in the current year from Form 6328, line 2.

- In Line 19, enter the lesser of the amounts from Lines 15 or 18; this value will be applied to tax.

- Line 20 is for subtracting line 19 from line 18 to determine the amount that may either be claimed as a refund or carried forward.

- In Line 21, enter the amount of credit requested as a refund, noting that this is subject to legislative appropriation.

- Complete the form by providing any additional information required in subsequent lines, ensuring each section is accurately filled as per the specific instructions provided in the form guidelines.

- Once all information is entered and reviewed, users can save changes, download, print, or share the form as needed.

Start completing your AK 0405-6300i form online today to claim your credits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The deadline to file Form 8843 is typically by June 15 for those who are non-resident aliens and do not have to file a tax return. However, if you have income and need to file a tax return, the deadline may be April 15. Ensure you verify specific deadlines for your circumstances. To navigate these timelines effectively, consider utilizing AK 0405-6300i for assistance and updates.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.