Loading

Get Irs 13614-c 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 13614-C online

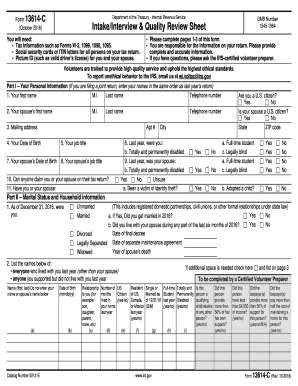

The IRS 13614-C form, known as the Intake/Interview & Quality Review Sheet, is crucial for effective tax preparation. This guide provides clear instructions on how to complete this form online, ensuring you have all necessary information at hand.

Follow the steps to accurately fill out the IRS 13614-C

- Click the ‘Get Form’ button to access the IRS 13614-C form and open it in your editor.

- Begin by completing Part I, which includes your and your spouse's personal information. Ensure that names are entered in the same order as your previous return. Include telephone numbers and your mailing address.

- Provide your date of birth and your spouse’s date of birth. Indicate if anyone can claim you or your spouse on their tax return, and respond to any identity theft or disability questions.

- In Part II, specify your marital status and household information, including whether you lived with your spouse during the last six months of the year.

- List everyone who lived with you last year and provide their details, including name, relationship, and any support provided.

- Proceed to Part III, where you will check off any income received last year. This includes wages, tips, scholarships, interest, and other income sources.

- In Part IV, indicate any expenses incurred last year, such as medical expenses, educational costs, and charitable contributions.

- Address any life events from the previous year in Part V, including changes to your home ownership status and participation in health savings accounts.

- Part VI focuses on health care coverage—indicate if you or your dependents had health coverage last year and provide any necessary forms.

- Complete Part VII, which includes additional information and questions about your tax return preparation and preferences.

- Conclude by reviewing all information provided for accuracy, then save your changes, download, print, or share the completed form as needed.

Take the next step in your tax preparation by completing the IRS 13614-C form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can obtain form 13614-C directly from the IRS website. It is available for download in PDF format, allowing you to print and fill it out. Additionally, some tax assistance programs may provide printed copies of the form for convenience. Accessing the IRS 13614-C is easy with these options at your disposal.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.