Loading

Get Irs 12854 2005-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 12854 online

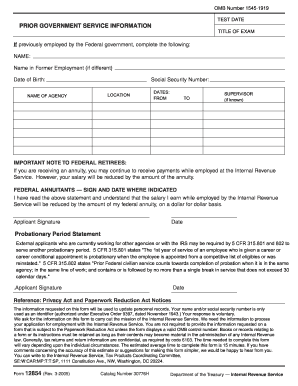

The IRS 12854 form is essential for updating personnel records, particularly for individuals with prior government service. This guide provides comprehensive, step-by-step instructions for filling out this form online, ensuring a smooth completion process for all users.

Follow the steps to successfully complete the IRS 12854 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the ‘Prior Government Service Information’ section, enter your full name, including any former names if applicable.

- Fill in your date of birth in the specified field. Make sure to enter it in the format requested on the form.

- Provide your Social Security Number in the designated area accurately.

- Indicate the location where you were employed by entering the city and state.

- In the ‘Name of Agency’ field, specify the agency where you previously worked.

- Fill in the dates of your employment by entering the start date in the ‘From’ field and the end date in the ‘To’ field.

- If known, name your supervisor in the field provided.

- Read the important note to federal retirees regarding annuity payments, then sign and date where indicated to acknowledge your understanding.

- If applicable, complete the ‘Probationary Period Statement’ section, signing and dating it as required.

- Finally, review all the information you provided to ensure accuracy before proceeding to save, download, print, or share the form as needed.

Complete your IRS 12854 form online today for a seamless application experience.

To apply for IRS hardship, you usually need to fill out Form 433 and provide documentation of your financial situation. This form illustrates your income, expenses, and assets to demonstrate your need. Remember, with IRS 12854, understanding these requirements can help ease your financial burden.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.