Get Irs 12509 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 12509 online

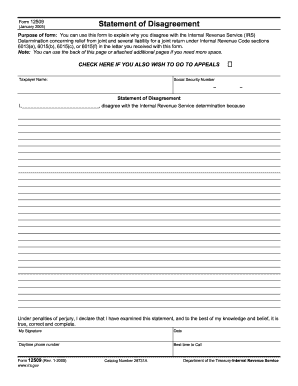

The IRS form 12509, also known as the statement of disagreement, is designed for taxpayers to formally express their disagreement with an IRS determination regarding relief from joint and several liability. This guide will provide you with clear and step-by-step instructions to help you fill out this form online effectively.

Follow the steps to complete the IRS 12509 form online

- Click 'Get Form' button to access the IRS 12509 form and open it for editing.

- Enter your personal information in the designated fields. This includes your full name and Social Security number, which will help identify your record with the IRS.

- In the statement of disagreement section, clearly articulate the reasons for your disagreement with the IRS determination. Ensure that your explanation is concise and to the point.

- Review the statement and ensure that all information is accurate. This is crucial as it declares under penalties of perjury that the details provided are true and complete.

- Provide your signature and the date to officially validate your statement of disagreement. You may also add a daytime phone number and indicate the best time to call for any follow-up.

- If needed, utilize additional pages to provide more information or details pertaining to your disagreement. Make sure to reference these pages in the form.

- Once you have completed all sections, save your progress. You may download, print, or share the form as necessary.

Complete your IRS 12509 form online today to ensure your disagreement is properly filed.

Get form

Related links form

Equitable relief considers several factors, including the length of the marriage, whether you will suffer economic hardship, and if the items causing the tax liability were known to you. Each case is evaluated individually under IRS 12509 standards. It helps to compile any supporting evidence demonstrating your position in the marriage. Services like uslegalforms can guide you through evaluating your circumstances.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.