Loading

Get Irs 1125-e 2016-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1125-E online

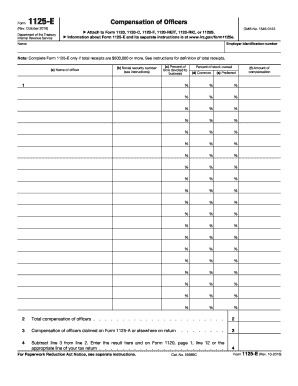

The IRS 1125-E form is used to report the compensation of officers for various corporate tax returns. This guide will walk you through the process of filling out the form online, ensuring clarity and accuracy as you navigate each section.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the employer identification number in the designated field. This number is crucial for the identification of your business.

- Enter the name of the officer in the respective field. Ensure accuracy as this information will be used for official records.

- For each officer listed, provide their Social Security number as instructed. This is necessary for tax reporting and verification purposes.

- Indicate the percent of time devoted to business by each officer in the appropriate field, providing percentage figures in decimal form.

- Fill in the percent of stock owned by each officer in both common and preferred categories. Ensure these entries reflect accurate ownership stakes.

- Record the amount of compensation for each officer. This figure should represent the total compensation paid during the reporting period.

- Sum the total compensation of all officers and enter this total in the designated line. This is necessary for accurate financial reporting.

- If applicable, include any compensation of officers claimed on Form 1125-A or elsewhere on your tax return in the next line.

- Subtract any compensation claimed from the total compensation amount and enter the result on the final line, ensuring this is accurately reflected on your relevant tax return.

Complete your IRS 1125-E form online to ensure accurate reporting of officer compensation.

The IRS does offer programs that can provide relief from certain penalties, sometimes referred to as first-time penalty abatement. These programs are usually available to taxpayers who have a clear compliance history. If you think you might qualify, it is best to explore these options thoroughly. Resources like uslegalforms can provide valuable insights and necessary paperwork to help you apply.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.