Loading

Get Irs 1120-w 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-W online

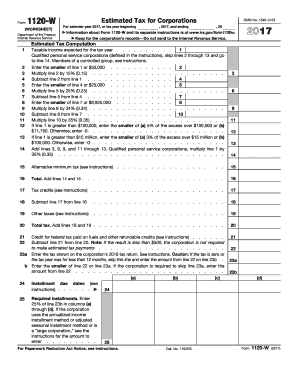

The IRS 1120-W is a worksheet used by corporations to estimate their tax liability for the year. This guide will provide clear, step-by-step instructions on how to effectively complete the form online, helping users navigate each section and field with ease.

Follow the steps to complete the IRS 1120-W form online.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Begin by filling in your corporation’s expected taxable income for the tax year on line 1. This is a crucial figure that will guide the rest of your calculations.

- On line 2, enter the smaller of line 1 or $50,000. This will help in determining your preliminary tax calculation.

- Multiply the amount in line 2 by 15% (0.15) and enter the result on line 3. This represents your initial estimated tax.

- Calculate the difference between line 1 and line 2, then input that value on line 4.

- Follow up by entering the smaller of line 4 or $25,000 on line 5, and then multiply that by 25% (0.25) for line 6.

- Subtract line 5 from line 4, and write the result on line 7.

- Identify the smaller value between line 7 or $9,925,000 and enter it on line 8.

- For line 9, multiply the value from line 8 by 34% (0.34). This is part of your tax computation.

- Subtract line 8 from line 7, and put that result on line 10. This step is essential for calculating your overall tax responsibility.

- Continue to multiply the amount found on line 10 by 35% (0.35) and record that value on line 11.

- If line 1 is greater than $100,000, calculate the lesser between 5% of the excess over $100,000 or $11,750 and enter this on line 12. If not, enter -0-.

- For corporations exceeding $15 million on line 1, the smaller of 3% of the excess over $15 million or $100,000 should be placed on line 13. Otherwise, input -0-.

- Add lines 3, 6, 9, and 11 through 13 to determine your total on line 14. For qualified personal service corporations, multiply line 1 by 35% (0.35) instead.

- For line 15, calculate and enter any alternative minimum tax based on provided instructions.

- Add lines 14 and 15 for the total tax owed on line 16.

- Next, input any applicable tax credits on line 17.

- Subtract line 17 from line 16 to find your net tax on line 18.

- You will then want to account for any additional taxes on line 19 and add these to line 18 on line 20.

- Review and ensure all calculations are correct, then you can save changes, download, or print the form for your records.

Complete your IRS 1120-W form online today to ensure timely and accurate tax submissions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing the IRS 1120-W yourself is possible if you have the necessary knowledge and tools. However, the complexities of tax law can make this challenging. Using a resource like US Legal Forms can provide you with templates and guidance to ensure a smooth filing experience. It is always beneficial to have support during tax season to minimize errors.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.