Get Irs 1120-pc 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-PC online

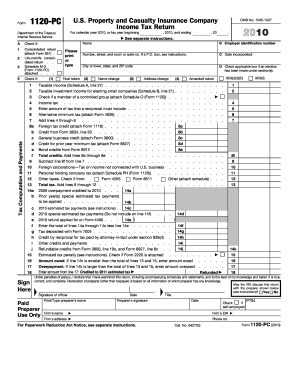

The IRS 1120-PC form is essential for U.S. property and casualty insurance companies to report their income, deductions, and tax liability. This guide provides a clear, step-by-step approach to help users fill out the form accurately online, ensuring compliance with IRS regulations.

Follow the steps to complete the IRS 1120-PC form online effectively.

- Press the ‘Get Form’ button to access the IRS 1120-PC and open it in your preferred online editor.

- Enter the employer identification number (EIN) in the designated field, ensuring accuracy to facilitate proper processing.

- Provide the name, address, and date of incorporation of your insurance company, using clear and correct formatting for seamless identification.

- Check the appropriate boxes if the return is final, amended, or if other elections under specific sections of the tax code are applicable.

- Complete the income sections, including taxable income and taxable investment income, as specified in Schedule A and Schedule B of the form.

- In the ‘Tax Computation and Payments’ section, find relevant fields for calculating income tax and credits including foreign tax credits and general business credits.

- Review any additional information required in Schedule M-1 or M-3, ensuring that total assets and any other pertinent details are accurately reported.

- Before finalizing, recheck all entries for completeness and accuracy, then save your changes to retain the filled form.

- Once satisfied with the information provided, you can download, print, or share the finalized form as needed for submission.

Complete your IRS 1120-PC form online today to ensure timely and correct submission!

Get form

Related links form

Form 1120 is typically completed by the business owner or an authorized representative within the corporation. It’s important that the person completing the form understands the financial details of the business. Accurate completion of the form can prevent errors and ensure compliance with tax laws. If needed, services like uslegalforms can assist you in filling out Form 1120 correctly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.