Loading

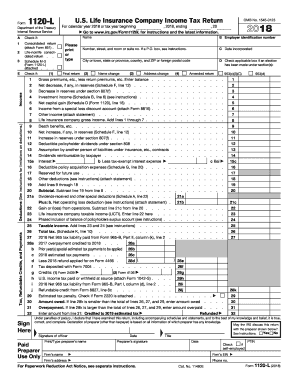

Get Irs 1120-l 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-L online

The IRS 1120-L form is essential for life insurance companies to report their income, deductions, and tax liability. This guide offers step-by-step instructions on filling out the form accurately and efficiently online.

Follow the steps to complete your IRS 1120-L online.

- Click ‘Get Form’ button to access the IRS 1120-L form and open it in the online editor.

- Fill in the basic information at the top of the form. This includes entering your company's name, employer identification number (EIN), and address details. Ensure the information is complete and accurate.

- For line (1), indicate if the return is consolidated by checking the appropriate box if applicable. If you are submitting a consolidated return, attach Form 851.

- In Section A, check the box for the type of tax return. Make sure to specify if this is a final return for the calendar year or other relevant tax year.

- Complete the income section. Report gross premiums received less return premiums in line 1. You will continue to fill out additional lines for investment income, net capital gains, and any other specified income sources.

- Proceed to deductions. This section is crucial for optimizing your tax liabilities. Input deductible policyholder dividends, expenses, and other deductions as instructed.

- Calculate life insurance company taxable income by combining the taxable income lines specified in the form. Ensure all calculations are accurate, as any misreporting could lead to issues with the IRS.

- For tax computation, complete the corresponding sections related to total tax, any credits, and overpayment/refunds. Double-check all data provided in this step.

- Review and sign the form. An authorized officer of the company must sign, date, and provide their title for verification.

- Once completed, save your changes, and download or print the form if necessary for your records. You may also share the completed form as required.

Start completing your IRS 1120-L form online today to ensure your compliance and timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can file IRS 1120-L online through various platforms that facilitate electronic submissions. This method often speeds up processing times and ensures that you meet deadlines easily. Platforms like US Legal Forms can help you prepare and submit your forms accurately online, eliminating errors and ensuring compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.