Loading

Get Irs 1120-f - Schedule M-1 & M-2 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-F - Schedule M-1 & M-2 online

This guide provides a comprehensive overview for users on how to fill out the IRS 1120-F - Schedule M-1 & M-2 online. By following the steps outlined, users can ensure accurate completion of these important forms for foreign corporations.

Follow the steps to fill out the IRS 1120-F - Schedule M-1 & M-2 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

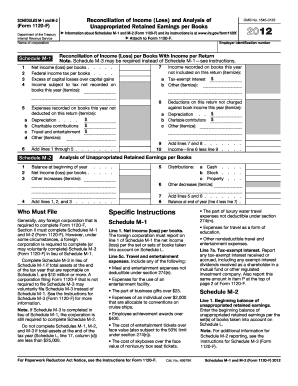

- Begin with Schedule M-1. On line 1, report the net income (loss) per the set or sets of books used for Schedule L. This reflects income based on accounting records.

- Proceed to line 7a on Schedule M-1 to report any tax-exempt interest received or accrued during the year.

- For deductions not charged against book income, list them in the relevant sections as required. This includes items such as depreciation and charitable contributions.

- Transition to Schedule M-2. Start with line 1 where you will enter the beginning balance of unappropriated retained earnings per your accounting books.

- Complete the necessary calculations for increases and decreases in retained earnings, ensuring all items are itemized as needed.

- Review all entries for accuracy before saving your changes. You can then download, print, or share the form as required.

Complete your IRS 1120-F - Schedule M-1 & M-2 forms online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Schedule M-2 is designed to track the changes in a foreign corporation's retained earnings over the tax year. This schedule works alongside Schedule M-1 to provide a comprehensive view of the corporation’s financial position. Understanding M-2 is crucial for accurate reporting and maintaining compliance with IRS regulations regarding retained earnings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.