Loading

Get Irs 1120-f - Schedule M-1 & M-2 2014

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-F - Schedule M-1 & M-2 online

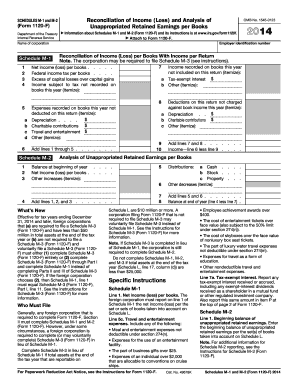

This guide provides clear and detailed instructions on how to fill out the IRS 1120-F - Schedule M-1 & M-2 online. Whether you are new to tax forms or looking for a concise overview, this resource will support you in accurately completing these schedules.

Follow the steps to fill out the IRS 1120-F - Schedule M-1 & M-2 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Fill in the employer identification number and the name of the corporation at the beginning of the form.

- Proceed to Schedule M-1. In line 1, report the net income (loss) per books. Ensure this reflects the records from your financial books.

- For line 5, list all expenses recorded on the books this year that were not deducted on the return. Breakdown expenses into specific categories such as depreciation, charitable contributions, and others.

- For Schedule M-2, begin by entering the balance at the beginning of the year for unappropriated retained earnings on line 1.

- Add any increases or decreases to retained earnings throughout the year as required in Schedule M-2.

- Review all entries for accuracy and completeness before finalizing. Make sure all figures are double-checked.

- Once everything is filled out, you may save changes, download a copy of the completed forms, print them, or share them as needed.

Begin completing the IRS 1120-F - Schedule M-1 & M-2 online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Schedule M-2 captures the changes in a corporation's retained earnings during the tax year. It includes adjustments from net income, distributions to shareholders, and other equity transactions. Properly documenting this information helps ensure accuracy in the IRS 1120-F tax submission and reflects the corporation's financial standing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.