Loading

Get Irs 1120-f - Schedule M-1 & M-2 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-F - Schedule M-1 & M-2 online

This guide provides a comprehensive overview of how to complete IRS 1120-F - Schedule M-1 & M-2 online. Following these steps will help ensure your form is completed accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and access it in your preferred editor.

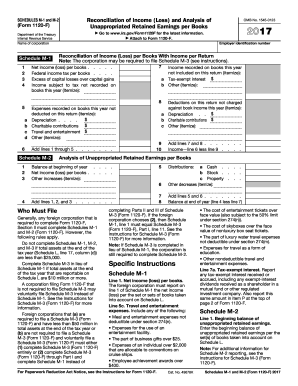

- Begin with Schedule M-1. On line 1, enter the net income (loss) per books from your accounting records. This represents the financial result based on your financial statements.

- Continue with line 5c where you will need to list travel and entertainment expenses that are not deductible, such as meal and entertainment costs, gifts exceeding $25, and certain convention expenses.

- For line 7a, report any tax-exempt interest received or accrued, including dividends from exempt-interest funds.

- After completing Schedule M-1, proceed to Schedule M-2. On line 1, enter the beginning balance of unappropriated retained earnings taken from your books.

- Follow through the remaining lines of Schedule M-2, ensuring to accurately record any increases or decreases in retained earnings and complete calculations as needed.

- Finally, review all entries for accuracy, then save your changes, and consider downloading, printing, or sharing the completed form as required.

Complete your IRS 1120-F - Schedule M-1 & M-2 online today to ensure compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Schedule 2 is often required for partnerships and corporations subject to additional taxes. It reports various types of tax credits and additional taxes owed. For precise compliance, always check if Schedule 2 applies to your specific tax situation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.