Loading

Get Irs 1120-c 2013

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-C online

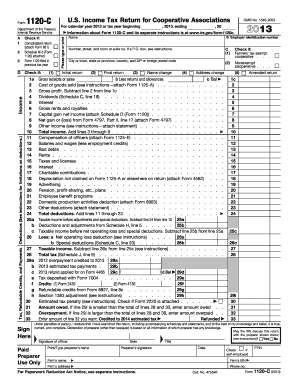

The IRS 1120-C form is used by cooperative associations to report their income, deductions, and tax liabilities. This guide provides a clear, step-by-step approach to completing the form electronically, ensuring that users can navigate the process effectively.

Follow the steps to complete the IRS 1120-C form online.

- Click ‘Get Form’ button to access the IRS 1120-C form online.

- Enter the name of your cooperative association as it appears on your official documents.

- Provide the employer identification number (EIN) of your cooperative association in the designated field.

- Fill in the address information, including the number, street, city, state, and ZIP code of your cooperative.

- Indicate whether this is your initial return, final return, or if there are changes to the name or address.

- Report your gross receipts or sales on line 1a, subtract returns and allowances on line 1b, and calculate the total on line 1c.

- Complete the cost of goods sold section by attaching Form 1125-A and calculating your gross profit.

- Enter any other incomes, such as dividends and interest, as instructed, and calculate your total income.

- List all deductions, including compensation, salaries, and taxes, by entering relevant data in the corresponding fields.

- Calculate total deductions by adding the lines as indicated, and determine taxable income by subtracting total deductions from total income.

- Complete the applicable sections for tax and payment, including any overpayments or credits from previous years.

- Sign the declaration section to certify that the information provided is accurate and complete.

- Finalize your filing by saving the changes, and consider downloading, printing, or sharing the completed form as necessary.

Complete your IRS 1120-C form online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form 1120 C is specifically designed for cooperatives that are taxed under subchapter C of the Internal Revenue Code. It allows cooperatives to report their income and expenses. If your organization operates as a cooperative, using the IRS 1120-C form is critical for accurate tax reporting.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.