Get Irs 1120 - Schedule G 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120 - Schedule G online

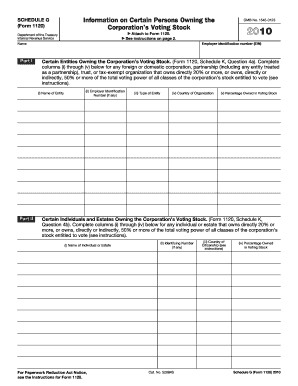

Completing the IRS 1120 - Schedule G online is essential for corporations that need to report information about certain entities and individuals owning their voting stock. This guide will help you navigate through the required sections and fields effectively.

Follow the steps to fill out Schedule G with ease.

- Click ‘Get Form’ button to access the Schedule G, allowing you to open it for editing.

- Enter your corporation’s name and employer identification number (EIN) at the top of the form.

- Proceed to Part I, which requires information on entities owning the corporation's voting stock. Fill in columns (i) through (v), listing the name of each entity, their EIN if applicable, the type of entity, the country of organization, and the percentage owned in voting stock.

- If applicable, move to Part II, where you need to provide details about individuals or estates owning the corporation's voting stock. Complete columns (i) through (iv) with the required information: the name of the individual or estate, their identifying number (if any), their country of citizenship, and the percentage owned in voting stock.

- Once all information is accurately filled out, review the form for accuracy. Ensure all entries are correct and complete.

- Finally, you can save your changes, download the completed form, print it for your records, or share it, depending on your filing process.

Start completing your IRS 1120 - Schedule G online today to ensure all necessary information is accurately reported.

Get form

Related links form

The purpose of Schedule G is to provide the IRS with detailed information about a corporation's shareholders, ensuring transparency in corporate tax filings. By clearly outlining ownership interests, this schedule helps facilitate proper tax assessment and compliance. Completing Schedule G accurately is vital in avoiding complications or audits related to shareholder disclosures.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.