Get Irs 1120 - Schedule D 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1120 - Schedule D online

How to fill out and sign IRS 1120 - Schedule D online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If you aren't linked to document administration and legal operations, submitting IRS documents can be exceptionally overwhelming. We recognize the importance of accurately completing paperwork.

Our web-based software provides an ideal solution to simplify the process of handling IRS documents as straightforward as possible.

Utilizing our online software will turn proficient completion of IRS 1120 - Schedule D into a reality. Ensure everything for your comfortable and secure work.

- Click on the button Get Form to access it and begin making changes.

- Fill all required fields in your document with our powerful and user-friendly PDF editor. Activate the Wizard Tool to make the process much simpler.

- Verify the accuracy of the entered information.

- Add the date of completing IRS 1120 - Schedule D. Use the Sign Tool to create a personal signature for the document's validation.

- Finish editing by clicking Done.

- Submit this document directly to the IRS using the method that is most convenient for you: via email, using virtual fax, or postal service.

- You can print it on paper if a hard copy is needed, and download or store it to your preferred cloud storage.

How to modify Get IRS 1120 - Schedule D 2014: personalize forms online

Utilize the convenience of the multi-featured online editor while completing your Get IRS 1120 - Schedule D 2014. Employ the range of tools to swiftly fill in the gaps and deliver the necessary information promptly.

Drafting documents is labor-intensive and costly unless you possess pre-made fillable forms and finalize them digitally. The most efficient method to handle the Get IRS 1120 - Schedule D 2014 is to utilize our expert and multifunctional online editing tools. We furnish you with all the crucial instruments for rapid document completion and permit you to modify your templates, tailoring them to any requirements. Furthermore, you can annotate the modifications and leave remarks for others involved.

Here’s what you can accomplish with your Get IRS 1120 - Schedule D 2014 in our editor:

Utilizing the Get IRS 1120 - Schedule D 2014 in our robust online editor is the fastest and most efficient method to organize, submit, and share your documentation as you need it from anywhere. The tool operates from the cloud, allowing you to access it from any location on any internet-enabled device. All templates you create or complete are securely stored in the cloud, ensuring you can always retrieve them when necessary and be assured of not losing them. Cease wasting time on manual document completion and eliminate paper; manage everything online with minimal effort.

- Fill in the gaps using Text, Cross, Check, Initials, Date, and Sign options.

- Emphasize important details with a preferred color or underline them.

- Obscure sensitive information with the Blackout option or simply erase them.

- Insert images to illustrate your Get IRS 1120 - Schedule D 2014.

- Replace the original text with the one aligning with your requirements.

- Add remarks or sticky notes to notify others about the revisions.

- Introduce additional fillable sections and assign them to specific recipients.

- Secure the document with watermarks, include dates, and bates numbers.

- Distribute the document in various formats and save it on your device or the cloud once you've finished modifying.

Get form

Related links form

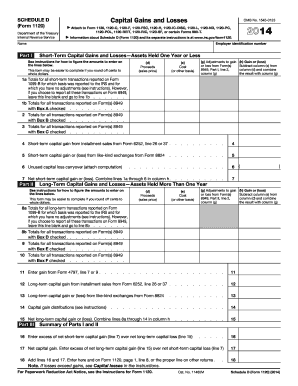

The Schedule D of Form 1120 is used to report capital gains and losses for corporations. This schedule details transactions concerning the sale of capital assets and ensures accurate tax reporting. Filing the IRS 1120 - Schedule D is critical for meeting your corporate tax obligations and clarifying your financial activity.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.