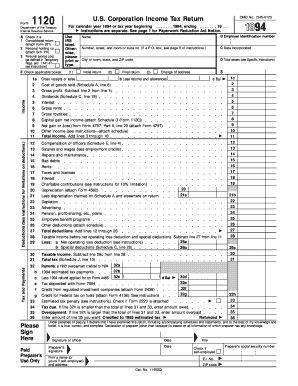

Get Irs 1120 1994

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1120 online

How to fill out and sign IRS 1120 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When people aren't linked to document management and legal procedures, submitting IRS forms appears challenging. We understand the importance of accurately filling out documents.

Our service offers the ability to simplify the process of filing IRS forms as straightforward as possible. Adhere to this guide to effectively and swiftly complete IRS 1120.

Using our service can truly facilitate the professional completion of IRS 1120. We will ensure everything is set for your comfortable and efficient work.

- Click the button Get Form to access it and commence editing.

- Fill in all necessary fields in the chosen document using our helpful PDF editor. Activate the Wizard Tool to complete the task more easily.

- Ensure the accuracy of the entered information.

- Include the date of completion for IRS 1120. Utilize the Sign Tool to create a unique signature for document validation.

- Finish editing by clicking on Done.

- Submit this document directly to the IRS in the most convenient way for you: via email, using online fax, or postal mail.

- You can print it if a hard copy is needed and download or save it to your preferred cloud storage.

How to modify Get IRS 1120 1994: personalize forms online

Your swiftly adjustable and customizable Get IRS 1120 1994 template is at your fingertips. Take advantage of our selection with an integrated online editor.

Do you delay completing Get IRS 1120 1994 because you simply don't know how to start and how to proceed? We recognize your sentiments and offer you a fantastic tool that has nothing to do with battling your procrastination!

Our online collection of ready-to-use templates allows you to browse and select from thousands of fillable forms tailored for various purposes and situations. But acquiring the document is only the beginning. We offer you all the necessary tools to fill out, certify, and modify the form of your choice without needing to leave our website.

All you need to do is to launch the form in the editor. Verify the wording of Get IRS 1120 1994 and check if it meets your expectations. Begin completing the template by utilizing the annotation tools to give your document a more structured and polished appearance.

In summary, alongside Get IRS 1120 1994, you will receive:

With our feature-rich solution, your finalized documents will almost always be legitimately binding and fully encrypted. We ensure the protection of your most sensitive information.

Obtain what is necessary to create a professionally appealing Get IRS 1120 1994. Make the right decision and try our system now!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, redact, and amend the existing text.

- If the form is meant for other individuals as well, you can add fillable fields and share them for others to complete.

- After you finish filling out the template, you can obtain the document in any available format or opt for any sharing or delivery options.

- A comprehensive set of editing and annotation tools.

- An integrated legally-binding eSignature capability.

- The ability to create documents from scratch or based on pre-uploaded templates.

- Compatibility with various platforms and devices for enhanced convenience.

- Multiple options for securing your documents.

- A broad range of delivery options for easier sharing and distributing files.

- Adherence to eSignature laws regulating the use of eSignature in electronic transactions.

Get form

Related links form

Absolutely, you can file IRS 1120 online. The IRS offers electronic filing options, making the process faster and more convenient. Additionally, many tax preparation services provide online filing capabilities to streamline your submission. Utilizing platforms such as uslegalforms can help simplify this process even further.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.