Loading

Get Irs 1099-r 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-R online

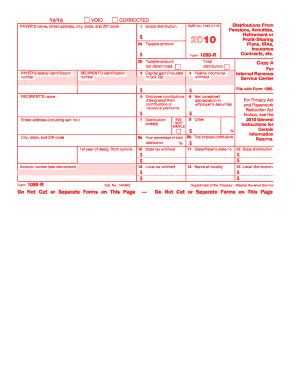

Filling out the IRS 1099-R form online is an essential task for individuals receiving distributions from pensions, annuities, retirement plans, and other financial products. This guide offers step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete the IRS 1099-R online.

- Click ‘Get Form’ button to acquire the IRS 1099-R form and open it in your preferred editor.

- Enter the name, street address, city, state, and ZIP code of the payer in the designated fields.

- In Box 1, input the total gross distribution you received during the tax year.

- Label Box 2a with the taxable amount. If it is not determined, check Box 2b.

- Fill out Box 3 with any capital gains included in Box 2a, if applicable.

- Enter the amount of federal income tax withheld in Box 4.

- Provide employee contributions in Box 5 if relevant.

- Indicate the net unrealized appreciation in Box 6, if applicable.

- Select the appropriate distribution code(s) in Box 7.

- Input additional tax information, including state tax withheld and local distribution information in the respective boxes.

- Review all your entries for accuracy before proceeding.

- Finally, save your changes, download, print, or share the completed form as needed.

Complete your IRS 1099-R form online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Financial institutions, retirement plan administrators, and insurance companies are responsible for sending out IRS 1099 forms, including the 1099-R. They must file these forms with the IRS and provide you with a copy for your records. If you have questions about your specific situation, uslegalforms can provide relevant information.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.