Loading

Get Ak Form 662sf 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 662SF online

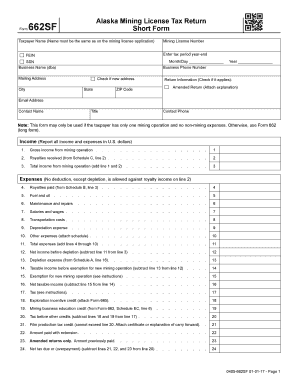

Filling out the AK Form 662SF online is a straightforward process that ensures your mining license tax return is submitted accurately. This guide provides clear, step-by-step instructions on how to complete each section of the form to meet your reporting requirements.

Follow the steps to successfully complete the AK Form 662SF online.

- Click ‘Get Form’ button to download the AK Form 662SF and open it in your preferred editor.

- Begin with the Taxpayer Name field. Ensure that the name entered matches exactly with the name on the mining license application. This is crucial for validation.

- Enter the Mining License Number in the designated field. This number is vital for identifying your specific mining operation.

- Fill in the FEIN (Federal Employer Identification Number) if applicable, followed by the SSN (Social Security Number) to ensure proper federal identification.

- Provide your Business Name as it appears or your 'Doing Business As' (dba) name. Following this, input your Business Phone Number and Mailing Address, ensuring accuracy to avoid communication issues.

- Check the box if you have a new address. Then complete the City, State, and ZIP Code fields to ensure your correspondence is sent to the correct location.

- Next, indicate if this is an amended return by checking the appropriate box and attaching a brief explanation if required.

- In the Income section, report your Gross income from the mining operation in the first line, followed by any Royalties received, ensuring accurate entries in U.S. dollars.

- Continue filling out the Expenses section. Provide details for each applicable expense listed, remembering that no deductions, except for depletion, are permissible against royalty income.

- After calculating your Total Income and Expenses, compute your Net income before depletion and subsequent taxable income by following the specified formulas.

- Proceed to fill out any applicable credits and tax amounts as laid out in the Tax section of the form.

- Finally, review all your entries for accuracy. Once complete, you can save your changes, download the filled form for your records, print it out, or share it as needed.

Complete your AK Form 662SF online today to ensure timely and accurate tax reporting for your mining operation.

Related links form

Completing a withholding exemption form starts with your personal information, such as your name and Social Security number. You must indicate your eligibility for exemption, based on your income or other qualifying conditions. Correctly filling this form can ensure you do not overpay taxes, similar to your calculations with the AK Form 662SF.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.