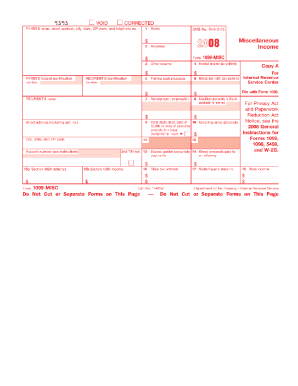

Get Irs 1099-misc 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1099-MISC online

How to fill out and sign IRS 1099-MISC online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If individuals aren't connected to document management and legal processes, submitting IRS forms will be quite challenging. We recognize the importance of accurately completing documents. Our service offers a resolution to simplify the process of submitting IRS forms.

Here are some suggestions to quickly and precisely fill out IRS 1099-MISC.

Using our online application can undoubtedly turn proficient filling of IRS 1099-MISC into reality. We will handle everything for your convenience and ease.

- Click the button Get Form to access it and begin editing.

- Complete all required fields in the document using our sophisticated PDF editor. Activate the Wizard Tool to make the process even easier.

- Ensure the accuracy of the information provided.

- Include the date of submission for IRS 1099-MISC. Use the Sign Tool to create a personal signature for the document's validation.

- Conclude editing by selecting Done.

- Send this document directly to the IRS in the most convenient way for you: via email, using online fax or postal mail.

- You can print it on paper when a hard copy is needed and download or save it to your preferred cloud storage.

How to Modify Get IRS 1099-MISC 2008: Personalize Forms Online

Handling paperwork is simpler with intelligent online resources. Remove paperwork with easily accessible Get IRS 1099-MISC 2008 templates that you can alter online and print.

Drafting documents should be more straightforward, whether it's a regular aspect of one’s job or infrequent tasks. When someone needs to submit a Get IRS 1099-MISC 2008, learning regulations and guidance on how to correctly fill out a form and what it should entail might require substantial time and energy. However, if you discover the appropriate Get IRS 1099-MISC 2008 template, completing a document will cease to be a struggle with an intelligent editor available.

Explore a wider range of functionalities you can integrate into your document workflow. No need to print, complete, and annotate forms manually. With a clever editing platform, all essential document processing capabilities are constantly available. If you aim to streamline your working process with Get IRS 1099-MISC 2008 forms, locate the template in the directory, choose it, and uncover a simpler method to complete it.

The more tools you are acquainted with, the easier it is to handle Get IRS 1099-MISC 2008. Experiment with the solution that offers everything needed to locate and modify forms in a single tab of your browser and eliminate manual paperwork.

- If you need to add text in any part of the form or insert a text field, utilize the Text and Text field tools to expand the text in the form as extensively as you require.

- Employ the Highlight tool to emphasize the main components of the form. If you wish to conceal or eliminate certain text sections, utilize the Blackout or Erase tools.

- Personalize the form by incorporating standard graphic features into it. Use the Circle, Check, and Cross tools to add these components to the forms, if needed.

- If additional notes are necessary, apply the Sticky note tool and place as many notes on the forms page as needed.

- If the form requires your initials or date, the editor has tools for those too. Minimize the likelihood of mistakes by using the Initials and Date tools.

- It is also feasible to add custom graphic components to the form. Use the Arrow, Line, and Draw tools for modifications.

Get form

Obtaining a copy of your IRS 1099-MISC is straightforward. Simply contact the issuer, and they can resend it to you. Alternatively, if you use a tax documentation platform like ulegalforms, you can access your forms more efficiently. It's essential to have these documents handy for your tax preparation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.