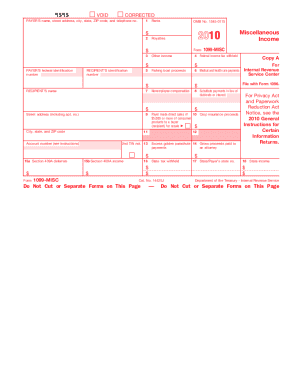

Get Irs 1099-misc 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1099-MISC online

How to fill out and sign IRS 1099-MISC online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t linked to document management and legal procedures, completing IRS forms can be surprisingly challenging.

We recognize the importance of accurately filling out documents.

Utilizing our platform can certainly transform proficiently filling out IRS 1099-MISC into a reality. We will ensure everything for your ease and seamless work.

- Click on the button Get Form to access it and begin modifying.

- Complete all necessary fields in the document using our user-friendly PDF editor. Activate the Wizard Tool to simplify the process further.

- Verify the accuracy of the entered information.

- Include the date of completion for IRS 1099-MISC. Utilize the Sign Tool to generate your personal signature for the document validation.

- Conclude editing by selecting Done.

- Send this document directly to the IRS in the most convenient manner: via email, digital fax, or postal service.

- You can print it on paper if a physical copy is needed and download or save it to your preferred cloud storage.

How to Modify IRS 1099-MISC 2010: Personalize Forms Online

Utilize our sophisticated editor to convert a basic online template into a finalized document. Continue reading to find out how to modify IRS 1099-MISC 2010 online effortlessly.

Once you find an ideal IRS 1099-MISC 2010 template, all you need to do is tailor the format to meet your specifications or legal obligations. In addition to completing the editable form with precise information, you might need to eliminate certain clauses in the document that are not applicable to your situation. On the contrary, you may wish to incorporate any absent terms in the original template. Our advanced document editing functions are the easiest way to amend and customize the form.

The editor allows you to alter the content of any form, even if the file is in PDF format. You can add and delete text, insert fillable fields, and make further modifications while retaining the original layout of the document. Additionally, you can reorganize the format by changing the order of the pages.

You don’t have to print the IRS 1099-MISC 2010 to endorse it. The editor includes electronic signing capabilities. Most forms already contain signature fields. Therefore, you only need to add your signature and request one from the other signing parties with a few clicks.

Follow this step-by-step guide to create your IRS 1099-MISC 2010:

Once all parties finalize the document, you will receive a signed copy that you can download, print, and distribute to others.

Our services allow you to save a significant amount of time and reduce the likelihood of errors in your documents. Enhance your document workflows with efficient editing tools and a robust eSignature solution.

- Open the desired template.

- Utilize the toolbar to modify the template according to your preferences.

- Complete the form with accurate details.

- Click on the signature field and include your electronic signature.

- Send the document for signing to other signers if needed.

Get form

If you do not report an IRS 1099-MISC on your tax return, the IRS may match it against their records. This inconsistency could lead to unexpected bills, fines, or penalties. It might also raise a red flag during an audit, resulting in further scrutiny. To evade these complications, be diligent about reporting all income as documented on your 1099-MISC.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.