Loading

Get Irs 1099-int 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-INT online

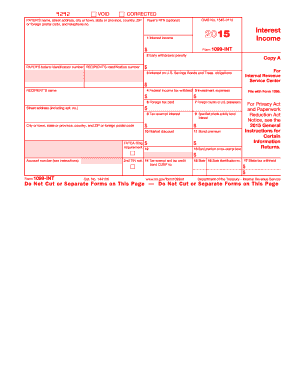

The IRS 1099-INT is an essential form for reporting interest income, including that from U.S. Savings Bonds and Treasury obligations. Filling out this form online can streamline the process and ensure accuracy.

Follow the steps to complete the IRS 1099-INT online.

- Click ‘Get Form’ button to access the 1099-INT form and open it in the online editor.

- In the ‘Payer’s name’ section, enter your name, address, city or town, state, ZIP code, and telephone number. Ensure all information is accurate to avoid issues.

- Fill in the ‘Payer’s federal identification number.’ This number is important for tax identification.

- Enter the recipient’s name and identification number in the corresponding fields.

- Complete Box 1 by reporting the total interest income paid to the recipient during the tax year.

- If applicable, indicate any early withdrawal penalties in Box 2.

- Fill out Boxes 3 through 12 as necessary, including any relevant amounts for U.S. Savings Bonds, federal taxes withheld, or investment expenses.

- For Box 15, report any state tax withheld and include the state identification number in Box 16.

- After completing the form, review all information for accuracy before saving your changes.

- You can then download, print, or share the completed form with necessary parties as required.

Begin filling out your IRS 1099-INT online today to stay compliant with tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To enter a 1099-NEC in TurboTax, navigate to the income section after logging in. Look for the prompt related to 1099-NEC and select it to enter the required details directly from your form. By using TurboTax, you streamline this process, ensuring correct entry of all relevant information.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.