Loading

Get Ak Form 6327 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 6327 online

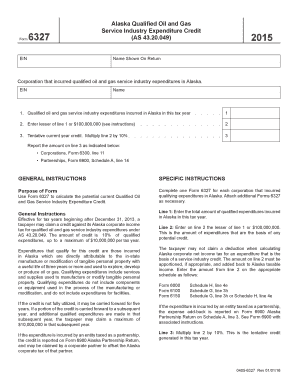

Filling out the AK Form 6327 is an essential process for corporations that have incurred qualified oil and gas service industry expenditures in Alaska. This guide will walk you through each component of the form, ensuring that you understand how to accurately complete it online.

Follow the steps to effectively fill out your AK Form 6327.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Enter your employer identification number (EIN) in the appropriate field as it is crucial for your tax identification.

- Provide the name shown on your return, making sure to enter it exactly as it appears on your official documents.

- In line 1, input the total amount of qualified oil and gas service industry expenditures incurred in Alaska during the current tax year.

- On line 2, write down the lesser amount between line 1 or $100,000,000. This value reflects the expenditures that will form the basis of your credit.

- For line 3, multiply the amount entered on line 2 by 10%. This figure represents your tentative current year credit.

- Review the instructions that accompany the form to ensure that you are reporting the amounts correctly based on your corporate structure.

- Once all fields are accurately completed, you can save your changes, download the form for your records, print it, or share it as needed.

Complete your AK Form 6327 online today for a streamlined filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A tax form with 'AK' typically relates to forms specific to the state of Alaska, including income tax and other relevant reporting requirements. These forms are essential for accurately filing state taxes and ensuring compliance with local regulations. Using the AK Form 6327 can clarify your obligations and assist you in filing the appropriate forms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.