Loading

Get Tx Ap-228-1 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX AP-228-1 online

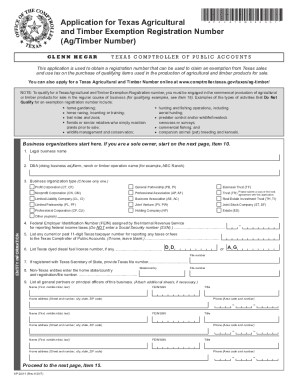

The TX AP-228-1 form is essential for individuals and businesses seeking a Texas Agricultural and Timber Exemption Registration Number. This document enables users to claim exemptions from sales and use tax for qualifying agricultural and timber products intended for sale.

Follow the steps to complete the TX AP-228-1 form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin with the entity information section. Provide any current or past Texas taxpayer number in the designated field. If you do not have a number, leave it blank.

- If applicable, enter the Texas dyed diesel fuel license number next. Follow this with your Texas Secretary of State file number if registered.

- For non-Texas entities, indicate your home state or country along with the associated registration or file number.

- List all general partners or principal officers of the business. Include their names, phone numbers, FEIN or SSN, titles, and home addresses. Use additional sheets if necessary.

- If you are a sole owner, provide your legal name in the designated field. Also, fill in your DBA (doing business as) name and Social Security number.

- Next, provide the mailing address where you would like any correspondence sent. Ensure all details are accurate and complete.

- Fill in the physical location of your business. It must be the primary address where agricultural or timber products are grown or raised. Do not use a P.O. Box for this address.

- Enter your email address and phone number for any necessary follow-up.

- Select the primary exempt activity from the provided options that best describes your agricultural or timber operations.

- Ensure all signatories (sole owner, general partners, or authorized representatives) sign and date the application appropriately.

- After completing the form, review it for completeness. You can save changes, download, or print the form as needed, then submit it according to the provided instructions.

Complete your TX AP-228-1 online today to ensure compliance with Texas tax regulations.

To qualify for an agricultural tax exemption in Texas, you need to demonstrate that your land is primarily used for farming or ranching. Gather documentation that shows your agricultural production and sales. Using the TX AP-228-1 form can help you compile the necessary information and streamline your application process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.