Loading

Get Ga It-303 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA IT-303 online

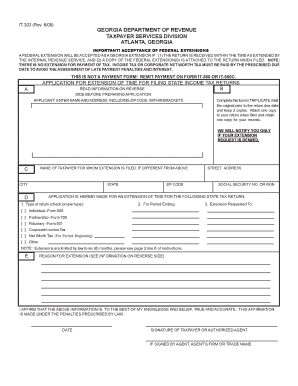

Filling out the GA IT-303 form for a tax extension is an essential step for individuals and businesses needing more time to prepare their state tax returns. This guide provides clear, step-by-step instructions to help you complete the form online with ease.

Follow the steps to accurately complete the GA IT-303 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name and address in the designated fields, including your ZIP code. Make sure all information is accurate and complete.

- If the extension is for a different taxpayer, provide their name in the appropriate field in section C.

- Indicate the type of return you are requesting an extension for by checking the appropriate box in section E. Options include Individual, Partnership, Fiduciary, Corporate Income Tax, and Net Worth Tax.

- Specify the period ending date and the date you are requesting the extension to in the provided fields.

- Provide a reason for the extension in section E. Make sure your explanation aligns with the acceptable conditions for granting extensions.

- Affirm the accuracy of the information by signing and dating the form. If an authorized agent is signing, they should include their firm or trade name.

- Complete the process by saving your changes, downloading a copy for your records, and preparing for submission. Ensure you attach any required documents before filing.

Complete your GA IT-303 form online today to ensure timely filing and avoid penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can electronically file a Georgia extension using the GA IT-303 form. Many tax software programs and online services, such as US Legal Forms, offer the option to e-file this extension seamlessly. E-filing provides immediate confirmation and is a faster way to manage your tax responsibilities. Make sure to file before the deadline to avoid penalties.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.