Get Ak Form 6325 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 6325 online

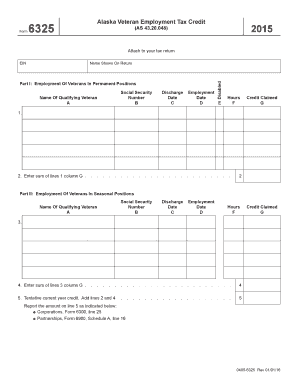

Filling out the AK Form 6325, which facilitates the Alaska Veteran Employment Tax Credit, can be essential for properly reporting your employment of qualified veterans. This guide provides a step-by-step approach to help users effectively complete the form online.

Follow the steps to accurately complete the AK Form 6325

- Press the 'Get Form' button to access the form and open it in the editing software.

- Enter your Employer Identification Number (EIN) in the designated field. This number is critical for your tax identification.

- Input the name shown on your tax return in the corresponding field to ensure consistency with submitted documents.

- Provide the Social Security Number for purposes of identification for credit claims.

- In Part I, list the name of the qualifying veteran under 'Name of Qualifying Veteran'.

- Fill in the discharge date of the veteran to establish their eligibility.

- Document the employment date of the veteran in the appropriate section.

- Specify the total hours worked by the veteran during the relevant period.

- Claim the credit in column G for the employment of the veteran based on the hours worked.

- For additional entries, repeat steps 5 to 9 as necessary for more veterans you are reporting.

- Sum the credits claimed in column G and note the total on line 2 for permanent positions.

- Proceed to Part II to report any seasonal positions. Repeat steps 4 to 11 for the veterans employed in these roles.

- After entering all necessary information, calculate the tentative current year credit by adding lines 2 and 4.

- Review all information entered to ensure accuracy, then save your changes.

- You can download, print, or share the completed form as needed for your tax documents.

Complete your documents online today to ensure timely and accurate tax reporting.

Get form

Forms K-2 and K-3 are necessary for partnerships and S corporations that have foreign activities or foreign partners. If your entity generates income from foreign sources or claims credits related to foreign taxes, you must file these forms. Understanding the requirements can ensure compliance with tax laws. For further information, uslegalforms provides comprehensive resources to clarify these obligations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.