Loading

Get Irs Instruction 1120s - Schedule K-1 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1120S - Schedule K-1 online

This guide provides clear and supportive guidance on how to accurately fill out the IRS Instruction 1120S - Schedule K-1 online. Users, regardless of their legal experience, will find comprehensive instructions tailored to their needs.

Follow the steps to complete Schedule K-1 effectively.

- Use the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by entering the shareholder's information. This includes the name, address, and taxpayer identification number (TIN) in the designated fields.

- Next, review the corporate information section. Fill in the corporation's name, address, and Employer Identification Number (EIN), ensuring all details are accurate.

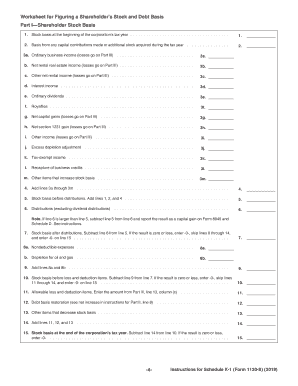

- Move on to the income section. Based on the corporation’s financial data, report your share of income, losses, deductions, credits, and other items in the appropriate boxes as shown in the form.

- Complete boxes 1 through 17, following the instructions carefully. Consult additional statements attached if required for more specific categories.

- Review the limitations section within the form, such as at-risk and passive activity limitations, to ensure all deductions are accounted for correctly.

- If applicable, fill out the credit section, providing any necessary backup information that corresponds with your shares.

- Finally, ensure you review all entered information for accuracy before saving your work. You can then save changes, download, print, or share the completed form.

Complete your IRS forms online today to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

1 income from an S Corp is generally taxed on the individual shareholder's personal tax return, as it passes through to them. According to IRS Instruction 1120S Schedule 1, this income is taxed at the shareholder’s applicable tax rate. It's essential to note that this income can be subject to selfemployment tax in certain circumstances. Being aware of how this income is taxed can help you plan your finances more effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.