Loading

Get Irs Instructions For Employee Copies Of W-2 Forms 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS instructions for employee copies of W-2 forms online

Filling out the IRS instructions for employee copies of W-2 forms online is a crucial step in ensuring accurate tax reporting. This guide will provide clear and user-friendly instructions to help users navigate the process with confidence.

Follow the steps to fill out the IRS instructions for employee copies of W-2 forms online.

- Press the ‘Get Form’ button to obtain the IRS instructions for employee copies of W-2 forms and open it in your preferred editing tool.

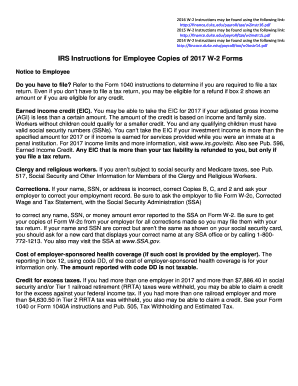

- Review the notice to employee section to understand your filing obligations. This includes determining if you need to file a tax return based on your tax situation and eligibility for credits such as the earned income credit.

- Fill in the correct amounts for each box on the form as instructed. For example, enter the correct amount in Box 1 that corresponds to wages on your tax return.

- Ensure that Box 2 is accurately filled with the federal income tax withheld for proper reporting on your return.

- If applicable, review Box 5 and fill out Form 8959 regarding additional Medicare tax if required.

- Check any information reported in Box 12 and ensure you understand the codes listed to correctly report this data on your tax return.

- Complete Box 13, checking the retirement plan box if necessary, as it affects IRA contribution limits.

- Use Box 14 for any additional information your employer may need to report, ensuring to understand what these entries mean for your tax return.

- Once all fields are accurately filled, save changes, download, print, or share the W-2 form as needed.

Complete your documents online with confidence and ensure your tax filings are accurate.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To retrieve W-2s from a job you no longer hold, first reach out to your former employer's payroll or HR department. They are legally required to provide you with copies of your W-2 when requested. The IRS Instructions for Employee Copies of W-2 Forms can guide you on your rights regarding these documents. If you encounter difficulties, online resources like US Legal Forms can assist you in navigating the process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.