Get Irs 712 2006-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 712 online

How to fill out and sign IRS 712 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

US Legal Forms serves as the leading source for expertly crafted documents and online templates.

Access a formal blank effortlessly at your convenience.

If you cannot locate the IRS 712 you require, do not forget to submit a draft request. We have made US Legal Forms accessible to all. Our specialists create samples with comprehensive instructions to ensure their accuracy, relevance, and reliability. We assist millions in saving time and money on legal fees.

- Do not waste your time on expensive and labor-intensive services.

- Simply search for your IRS 712 online using our reliable and extensive catalog featuring state-specific forms and examples.

- Refer to the straightforward guide to obtain your IRS 712:

- Access the site’s search function or browse templates categorized.

- Select your state from the list and enter your search phrase. This step is crucial as various states require unique formats per their guidelines.

- Choose the document you need from the search results to view more information and a free preview.

- Examine the IRS 712 preview. If available, ensure you locate the necessary blank.

- Review further details about the information provided and look for any associated electronic downloads. You might require additional documents to support your current record.

- Add the item to your cart. You can immediately purchase the download or request a physical copy to be sent to your mailing address.

- Proceed to checkout or continue shopping.

How to amend Get IRS 712 2006: tailor forms online

Utilize our vast online document editor while creating your forms. Complete the Get IRS 712 2006, highlight the most significant details, and smoothly make any other necessary adjustments to its content.

Filling out documents digitally is not just a time-saver but also provides an opportunity to alter the template according to your requirements. If you wish to handle the Get IRS 712 2006, consider finishing it with our thorough online editing tools. Whether you make a mistake or input the required data into the incorrect section, you can quickly amend the document without needing to start over like in manual completion.

Additionally, you can emphasize the critical information in your document by coloring specific portions, underlining them, or circling them.

Our comprehensive online solutions are the most efficient way to complete and tailor Get IRS 712 2006 to fit your needs. Use it to manage personal or business documents from any location. Open it in a browser, make the necessary modifications to your documents, and return to them anytime in the future - they will all be securely stored in the cloud.

- Access the file in the editor.

- Input the necessary information in the empty fields using Text, Check, and Cross tools.

- Follow the document navigation to ensure no required fields in the template are overlooked.

- Circle some of the pivotal details and attach a URL to them if required.

- Utilize the Highlight or Line tools to underscore the most crucial facts.

- Select colors and thickness for these lines to enhance the professional appearance of your sample.

- Erase or blackout any information you wish to conceal from others.

- Replace segments of content that contain mistakes and input text that you need.

- Conclude editing with the Done button when you are certain everything is accurate in the document.

Related links form

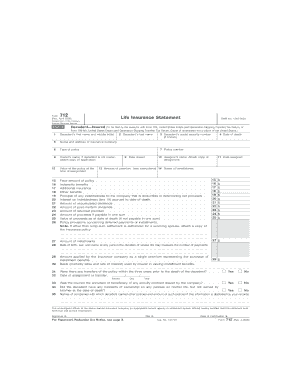

You need IRS Form 712 to report the value of life insurance policies as part of the estate tax process. This form provides the IRS with crucial information regarding any proceeds from life insurance that may be included in the estate's valuation. Understanding how to use Form 712 effectively can aid in fulfilling your tax obligations smoothly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.