Get Ma Dor Ifta-1 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MA DoR IFTA-1 online

How to fill out and sign MA DoR IFTA-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Documenting your income and submitting all the essential tax documents, including MA DoR IFTA-1, is the sole responsibility of a US citizen.

US Legal Forms simplifies your tax management, making it clearer and more accurate.

Safeguard your MA DoR IFTA-1. Ensure that all your relevant documents and records are organized while keeping in mind the deadlines and tax regulations established by the Internal Revenue Service. Make it easy with US Legal Forms!

- Obtain MA DoR IFTA-1 through your web browser from any device.

- Access the fillable PDF file with a single click.

- Initiate filling out the template box by box, adhering to the guidance of the advanced PDF editor's interface.

- Carefully enter text and digits.

- Click on the Date field to automatically set the current day or adjust it manually.

- Utilize the Signature Wizard to create your customized e-signature and sign effortlessly.

- Refer to the IRS guidelines if you still have inquiries.

- Click on Done to save the changes.

- Continue to print the document, download it, or share it via Email, text message, Fax, or USPS without closing your web browser.

How to modify Get MA DoR IFTA-1 2019: personalize forms online

Utilize our vast online document editor while assembling your documentation.

Complete the Get MA DoR IFTA-1 2019, specify the most essential details, and effortlessly make any other required modifications to its content.

Filling out documents digitally is not only efficient but also allows you to adjust the template according to your preferences.

Our robust online solutions are the most effective means to fill out and adjust Get MA DoR IFTA-1 2019 according to your specifications. Use it to create personal or business documents from any location. Access it in a browser, make modifications to your forms, and return to them at any time in the future - they will all be securely stored in the cloud.

- Launch the file in the editor.

- Enter the necessary information in the empty fields using Text, Check, and Cross tools.

- Follow the document navigation to ensure you don’t overlook any compulsory fields in the template.

- Circle some critical details and add a URL if necessary.

- Use the Highlight or Line options to emphasize the most significant pieces of content.

- Select colors and thickness for these lines to give your form a professional appearance.

- Erase or blackout the information you prefer to keep hidden from others.

Get form

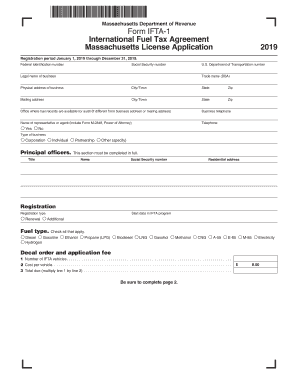

IFTA, or the International Fuel Tax Agreement, simplifies fuel tax reporting for truckers operating in multiple states. Instead of filing separate tax returns for each state, IFTA allows you to report total miles traveled and fuel bought within all member states. This makes it easier to manage your fuel tax obligations without getting overwhelmed by state-specific regulations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.