Get Nc Dor D-400 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR D-400 online

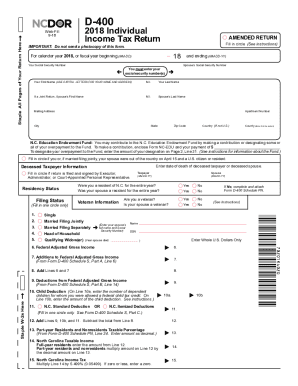

The NC DoR D-400 form is essential for filing your individual income tax return in North Carolina. This guide provides clear instructions on how to successfully complete the form online, ensuring your tax submission is accurate and complete.

Follow the steps to fill out the form effectively.

- Press the ‘Get Form’ button to access the D-400 form and open it in your preferred online editing tool.

- Begin by entering your personal information, including your Social Security number, name, and address in capital letters, as required. If applicable, include your spouse's details.

- Indicate your residency status and filing status by filling in the appropriate circles on the form. Options include single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Provide necessary information regarding veteran status for both you and your spouse, by marking the corresponding no or yes options.

- Continue to fill in the income section by entering your Federal Adjusted Gross Income and any additions or deductions relevant to your tax return.

- Complete the child deduction section by indicating the number of dependent children and the amount of the child deduction.

- Calculate your North Carolina taxable income by following the outlined instructions using prior calculations.

- Proceed to the tax liability section where you will determine your North Carolina income tax based on the taxable income entered.

- Check for any credits and adjustments, and ensure you account for all tax payments made throughout the year.

- After reviewing all entered information for accuracy, finalize your submission by saving changes, downloading, printing, or sharing your completed form as needed.

Complete and submit your NC DoR D-400 form online today for a smooth tax filing experience.

Get form

Related links form

Currently, there are no definitive plans to eliminate state income tax in North Carolina. The state relies on income tax as a key revenue source for education, transportation, and public services. While discussions about tax reform occur regularly, it is important to stay informed through official state announcements. Utilizing resources such as the NC DoR can help you understand potential changes affecting your tax situation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.