Get Fl Dr-15mo 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-15MO online

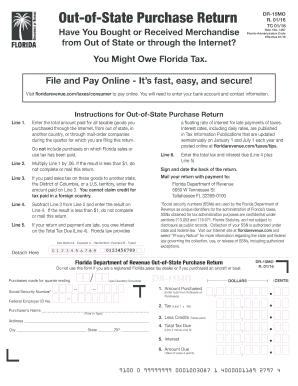

Filling out the FL DR-15MO form for out-of-state purchases is an essential step in ensuring compliance with Florida tax regulations. This guide provides a clear, step-by-step process for completing the form online, making it accessible for all users, regardless of their legal experience.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In the first section, enter the total amount paid for all taxable goods that were purchased out of state or over the Internet during the filing quarter. This should be recorded on Line 1.

- Calculate the tax amount by multiplying the Line 1 total by 0.06. This figure should be entered on Line 2. If the result is less than $1, you need not complete or submit the return.

- If applicable, enter any sales tax you paid to another state on Line 3. Note that credits for tax paid in foreign countries are not allowed.

- Subtract any tax paid (Line 3) from the calculated tax amount (Line 2) and record the difference on Line 4. If this amount is less than $1, skip submission.

- If your return and payment are late, indicate any interest owed on Line 5, according to applicable Florida laws.

- Sum the total tax due (Line 4) and any interest charges (Line 5), and enter this final amount on Line 6. This is the total amount due.

- Sign and date the form on the back to certify accuracy and compliance.

- Finally, ensure that you save your changes and choose to download, print, or share the completed form as needed.

Complete your FL DR-15MO form online today to ensure your compliance with Florida tax regulations.

Yes, you can amend a Florida sales tax return by filing a new return that reflects the correct information. When amending, indicate that it is an amended return and provide any explanations necessary for the changes. Timely submission is important to avoid potential penalties associated with unfiled or incorrect returns. Keeping organized records can facilitate this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.