Loading

Get Va Dot R-1 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT R-1 online

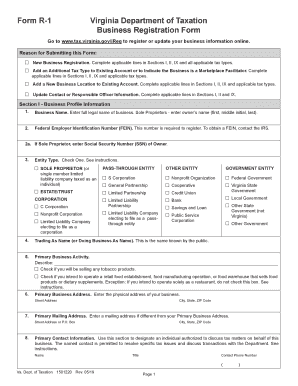

Filling out the VA DoT R-1 form is an essential step for registering or updating your business information in Virginia. This guide provides clear and supportive instructions to ensure you complete the form correctly and efficiently.

Follow the steps to successfully complete the VA DoT R-1 form online.

- Press the ‘Get Form’ button to access the document and open it in the editor.

- Section I - Business Profile Information: Start by entering the full legal name of your business. If you are a sole proprietor, please enter your name instead.

- Enter your Federal Employer Identification Number (FEIN). If you do not have one, refer to the IRS for assistance in obtaining it.

- Select your entity type by checking the appropriate box. Ensure you understand each option to choose the one that best fits your business structure.

- Fill in the Trading As Name (DBA) if applicable; this is the name recognized by the public.

- Describe your primary business activity clearly. Check any relevant boxes if you will be selling tobacco products or if your business involves food-related operations.

- Provide your primary business address, including city, state, and ZIP code, then fill in your primary mailing address if different from your business address.

- Enter primary contact information for someone authorized to discuss tax matters for your business.

- Proceed to Section II - Responsible Party, identifying the corporate or partnership officers responsible for tax obligations. Fill in their names, SSNs, titles, and contact details.

- Complete subsequent sections, which include tax details pertinent to your business operations. Make sure to understand requirements for each tax type you are registering for.

- In the final sections, provide all necessary contact information and ensure the form is signed electronically or print it out for a manual signature.

- Once you have filled out the form, you can save your changes, download it for your records, print it out, or share it as needed.

Take action today and complete your VA DoT R-1 form online to ensure your business is properly registered.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain a VA 1099 form online, visit the official website of the Virginia Department of Taxation or the IRS. The forms are usually available in PDF format for download. After filling out the necessary information, submit it electronically through the e-filing system if applicable. For more streamlined assistance, you may explore options using VA DoT R-1.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.