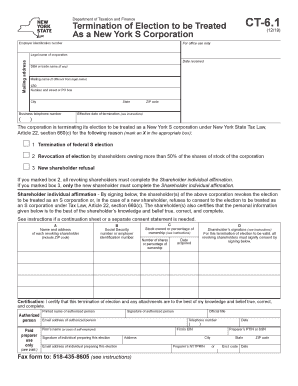

Get Ny Ct-6.1 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY CT-6.1 online

How to fill out and sign NY CT-6.1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans prefer to handle their own tax filings and additionally complete forms in a digital format.

The US Legal Forms online platform facilitates a smooth and straightforward e-filing process for the NY CT-6.1.

Ensure you have accurately completed and submitted the NY CT-6.1 in a timely manner. Consider any relevant deadlines. Providing incorrect information in your financial documents can lead to hefty penalties and complications with your yearly tax submission. Be certain to utilize only verified templates from US Legal Forms!

- Access the PDF document in the editor.

- Locate the highlighted fillable areas where you can enter your details.

- Select the options if checkboxes are visible.

- Go to the Text icon along with other enhanced functionalities to edit the NY CT-6.1 manually.

- Double-check all information prior to proceeding with your signature.

- Create your custom eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Confirm your PDF form electronically and specify the exact date.

- Click Done to continue.

- Save or forward the document to the recipient.

How to modify Get NY CT-6.1 2019: personalize documents online

Sign and distribute Get NY CT-6.1 2019 along with any additional business and personal paperwork online without squandering time and resources on printing and postal delivery.

Maximize the benefits of our online document editor equipped with an integrated compliant eSignature tool.

Signing and submitting Get NY CT-6.1 2019 documentation digitally is quicker and more effective than handling them on paper. Nevertheless, it necessitates utilizing online solutions that ensure a high standard of data security and offer you a compliant tool for generating electronic signatures.

Distribute your documents with others using one of the available methods. When finalizing Get NY CT-6.1 2019 with our powerful online editor, you can always be confident that it is legally binding and acceptable in court. Prepare and submit documents in the most effective manner possible!

- It requires only a few straightforward steps to complete and sign Get NY CT-6.1 2019 online:

- Open the chosen document for further management.

- Employ the top panel to incorporate Text, Initials, Image, Check, and Cross indicators to your template.

- Highlight the key information and black out or eliminate the sensitive ones if needed.

- Click on the Sign tool above and choose how you wish to eSign your document.

- Sketch your signature, type it, upload a photo of it, or utilize another option that fits your preference.

- Switch to the Edit Fillable Fields panel and add Signature fields for additional signers.

- Click on Add Signer and provide your recipient’s email to designate this field to them.

- Ensure that all provided information is complete and accurate before you click Done.

Related links form

S-corporations are pass-through entities. That is, the corporation itself is not subject to federal income tax. Instead, the shareholders are taxed upon their allocated share of the income. ... Shareholders do not have to pay self-employment tax on their share of an S-corp's profits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.