Get Ny Dof Cr-q2 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DoF CR-Q2 online

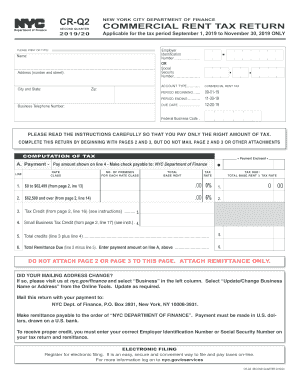

Filling out the NY DoF CR-Q2 form for the Commercial Rent Tax can be a straightforward process if you have the right guidance. This form is necessary for reporting your commercial rent during the specified tax period and ensuring correct tax assessment.

Follow the steps to successfully complete the NY DoF CR-Q2 form online.

- Click the ‘Get Form’ button to obtain the CR-Q2 form and open it in your editor.

- Begin by filling in your name in the designated field. Ensure that all information is accurate and clear, as this will be essential for processing your tax return correctly.

- Next, provide your full address, including the number and street, city, state, and zip code. Double-check for accuracy to avoid any issues with your submission.

- Enter your business telephone number and choose whether to provide your Employer Identification Number or Social Security Number. This information is critical for identification purposes.

- Fill in the account type and the commercial rent tax period. This section will specify the time frame for which you are reporting, ensuring compliance with the tax period stated in the instructions.

- Proceed to the computation of tax section. You will have to calculate your total base rent and determine the applicable tax rate based on the rent bracket into which your amount falls.

- Continue through the form meticulously, ensuring you complete each section. This includes any deductions, credits, and the total remittance due. Remember, accuracy is crucial; any discrepancies may lead to delays or audits.

- Once you have filled out all necessary fields, review the form for any errors or missing information. It is advisable to double-check the totals calculated to ensure everything is correct.

- Finally, you can save your changes, download the completed form, or share it as needed. Make sure to keep a copy for your records before submission.

Complete your NY DoF CR-Q2 form online today to ensure timely processing and compliance with tax regulations.

Get form

Related links form

To obtain an exemption from sales tax in New York, you must demonstrate that your purchases meet specific criteria established by the state's tax regulations. Typically, this involves applying for a sales tax exemption certificate when conducting relevant transactions. For detailed guidance, the NY DoF CR-Q2 provides essential information, and resources like uslegalforms can assist in documenting your request properly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.